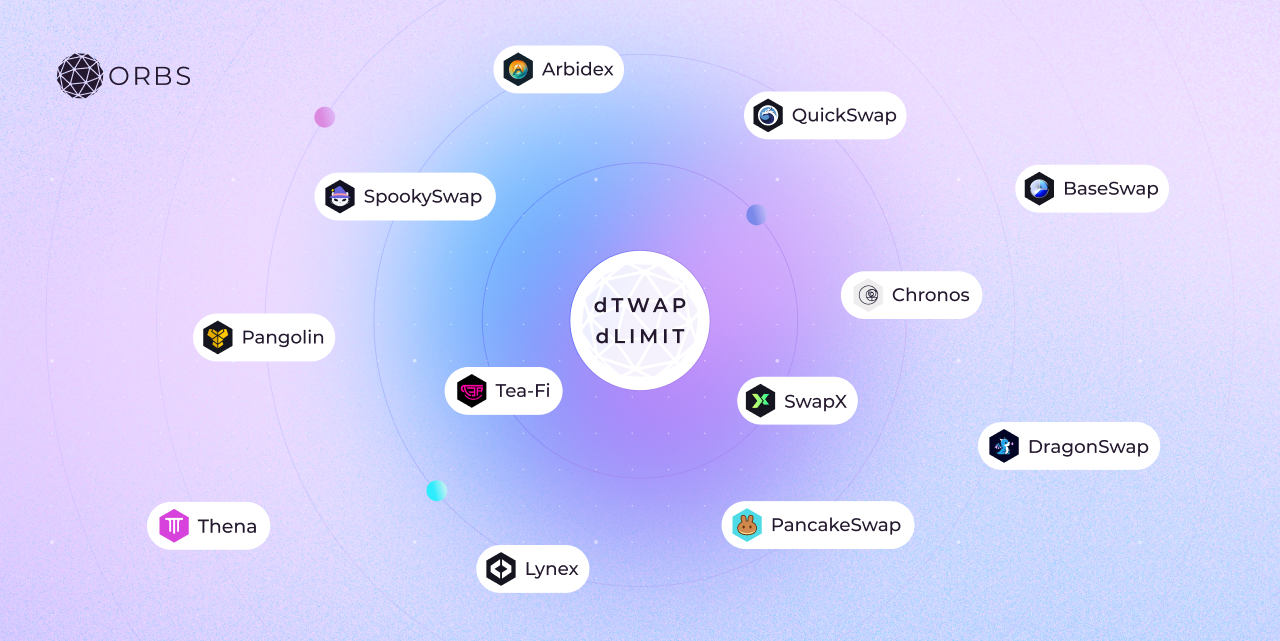

ArbiDex and BaseSwap, OG adopters of the once-niche dTWAP and dLIMIT protocols by Orbs, are back, relaunching with a fresh UI, an incentives program, and more. dTWAP and dLIMIT are already live on both decentralized venues, already facilitating advanced order types once again.

As a result, ArbiDex and BaseSwap traders now have access to both advanced order types, enabling them to either lock in the price of their trades or split large orders into smaller ones. This integration follows successful implementations with other prominent DEXs, further solidifying Orbs’ position as the go-to solution for advanced DeFi orders and showcasing its unique Layer 3 technology, which brings CeFi-level execution capabilities to DeFi.

dLIMIT is a fully decentralized, permissionless, and composable DeFi protocol developed by Orbs and powered by the Orbs Network. ArbiDeX and BaseSwap have also integrated decentralized time-weighted average price (dTWAP) orders, as supported by Orbs, which enables this widely used algorithmic trading strategy.

Orbs operates as a decentralized protocol managed by a public network of permissionless validators using PoS, with tens of millions of dollars staked in TVL. The protocol enhances on-chain trading with L3 use cases like aggregated liquidity, advanced trading orders, and decentralized derivatives, bringing an efficient CeFi-like trading experience to DeFi.

For those who are unfamiliar, a Limit order allows users to buy or sell tokens at a specific price. While the specified price is guaranteed, the execution of the order is not, and depends on market movement. Limit orders will only be executed if the market price meets the order specifications.

A TWAP or DCA order in the case of ArbiDex or BaseSwap (Time-Weighted Average Price) order is a trading strategy that aims to reduce the impact of executing a large order all at once by breaking it down into smaller portions over a set time period. This approach helps minimize price volatility and allows traders to acquire or sell assets gradually. In crypto, where prices can shift rapidly, TWAP strategies are especially effective for reducing slippage and achieving more consistent execution.

ArbiDex & BaseSwap traders can now utilize these key traditional finance orders without sacrificing decentralization.

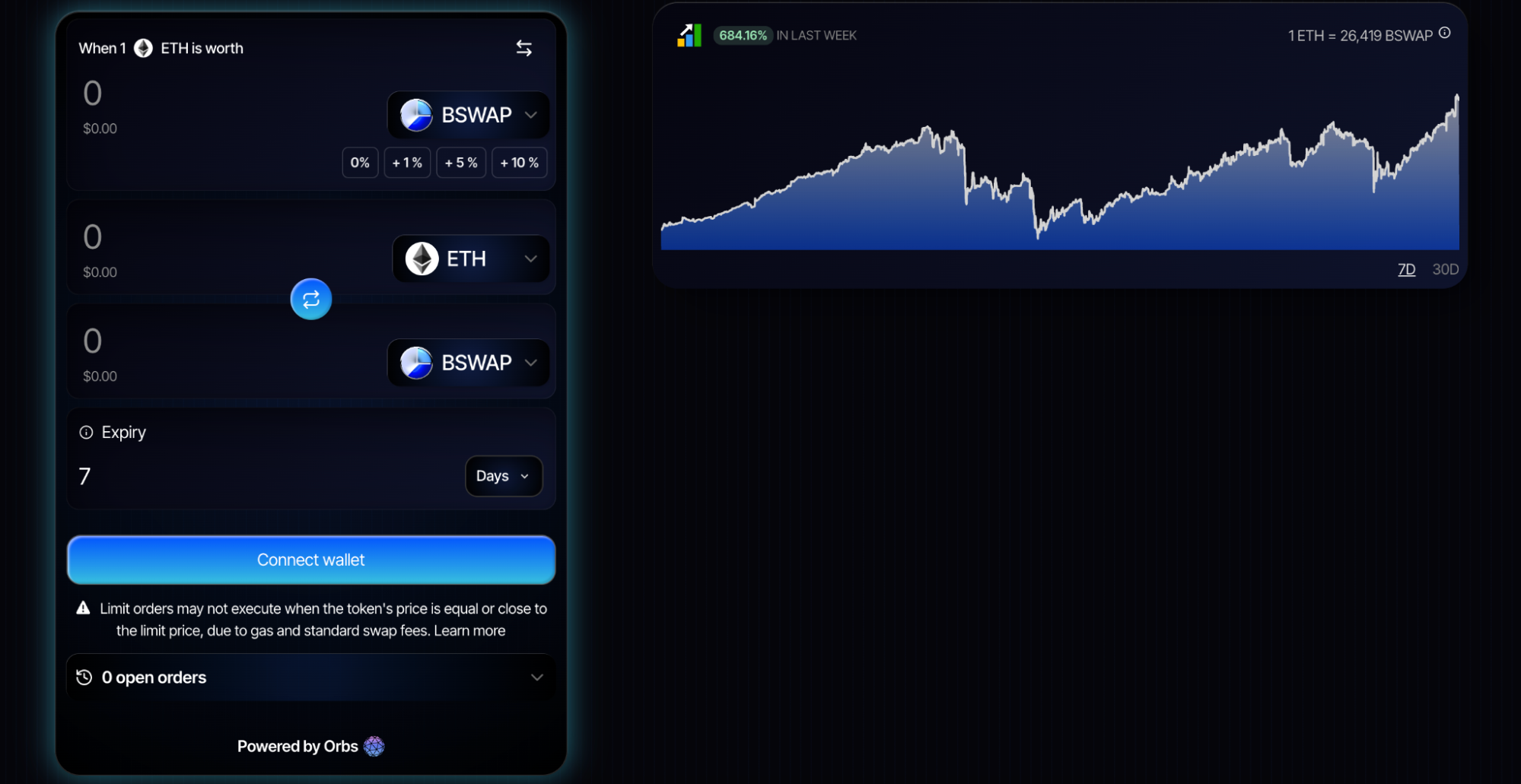

When switching to a dLIMIT ‘swap’ on ArbiDEX or BaseSwap, users are presented with an easy-to-follow user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLIMIT order, traders must specify the following:

dLIMIT takes into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order live in the ‘order history’ tab.

For a dTWAP order, three additional parameters need to be specified:

Similarly to dLIMIT, these parameters offer incredible flexibility in customizing each order, taking into account factors such as market conditions and current gas fees. Additionally, the UI facilitates both dTWAP-market orders, which execute all trades at the available market price, and dTWAP-Limit orders, which only execute individual trades if they are within the price Limit set by the user. Once these parameters are set, the user can approve the specific source token, place the order, and confirm the user-specified configuration.

The dLIMIT & dTWAP protocols, powered by Orbs L3 technology, have become the industry standard for decentralized algorithmic orders in DeFi. The ‘powered by Orbs branding’ has become a staple of confidence when executing advanced orders on decentralized venues.

Together with other L3-powered protocols, LIquidity Hub for aggregated liquidity and Perpetual Hub for decentralized on-chain perpetual futures.

Join the support telegram channel for more information regarding both advanced order types.

Find out more info:

About Orbs

Orbs is a decentralized Layer-3 (L3) blockchain designed specifically for advanced on-chain trading.

Utilizing a Proof-of-Stake consensus, Orbs acts as a supplementary execution layer, facilitating complex logic and scripts beyond the native functionalities of smart contracts. Orbs-powered protocols, including dLIMIT, dTWAP, Liquidity Hub, and Perpetual Hub, push the boundaries of DeFi by introducing CeFi-level execution to on-chain trading.

With a global team of over forty dedicated contributors based in Tel Aviv, London, New York, Tokyo, Seoul, Lisbon, and Limassol, Orbs continues to innovate at the forefront of blockchain technology.

For more information, visit www.orbs.com or join our community:

Telegram: https://t.me/OrbsNetwork

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.