The Open DeFi Notifications Protocol has integrated with Y2K Finance, the first project on Arbitrum to integrate.

Y2K is a suite of structured products for exotic peg derivatives that will allow market participants the ability to hedge or speculate on the risk of a particular pegged asset. So far, the protocol has supported a deposit value of over 123 million with ‘Earthquake’ payouts exceeding 13 million.

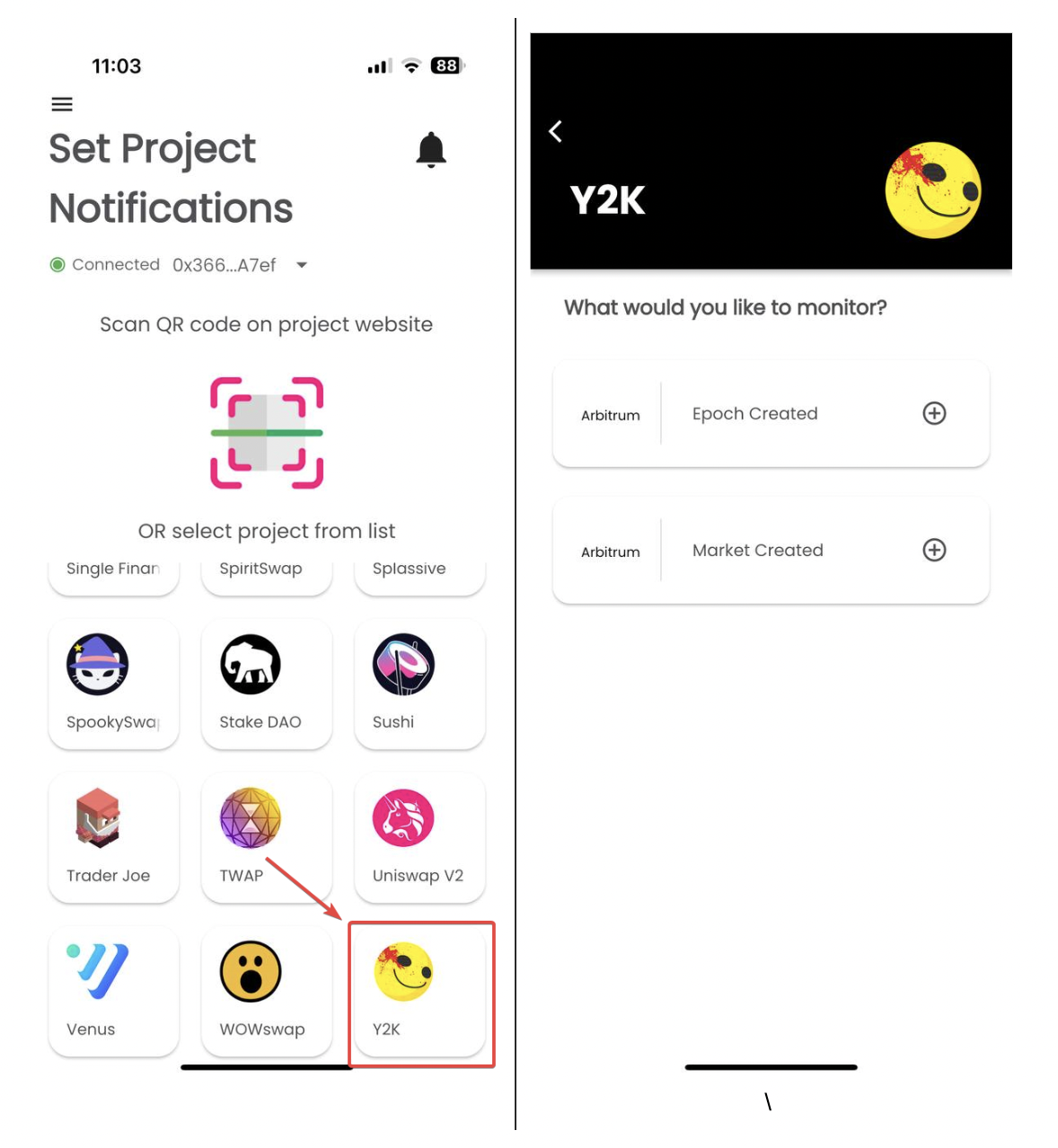

Y2K users can now set up Epoch and Market created notifications to provide 24/7 monitoring of mint periods.

The Open DeFi Notification Protocol App is available on the Apple AppStore and Google Play.

The Open DeFi Notification Protocol by defi.org is a community led initiative to provide users with decentralized and free mobile notifications for on-chain events.

Y2K enables its users to speculate on the risk of a particular pegged asset (or basket of pegged assets), deviating from their ‘fair implied market value’. Currently, the protocol supports 11 different assets & ‘markets’.

On a weekly rolling basis, a new epoch is created where users can choose to deposit and either ‘hedge’ or ‘risk’. A hedge is an insurance on any de-peg event during the epoch. Conversely, risk involves ‘selling’ insurance to hedgers during the epoch.

During the epoch, if the vault does de-peg, Hedge vault depositors transfer their paid-up premiums to the Risk vault depositors. Hedge vault depositors receive a pro-rata share of Risk vault deposits. If the asset does not de-peg, Risk vault depositors receive their premiums from the Hedge vault depositors. Due to the frequency and new markets being created on-chain epoch deployments can be difficult to keep track of.

Well, not anymore!

Using the Open DeFi Notification Protocol, Y2K users can set up an “Epoch Created” and “Market Created” notification which will issue an alert when a new Epoch begins, or a new market is supported. In this way, users have 24/7 monitoring of their position status and can take immediate action in order to mitigate the risk of stablecoin de-pegging or generate yield from market speculation.

The Open DeFi Notification Protocol is an open initiative to provide users with decentralized and free mobile notifications for on-chain events.

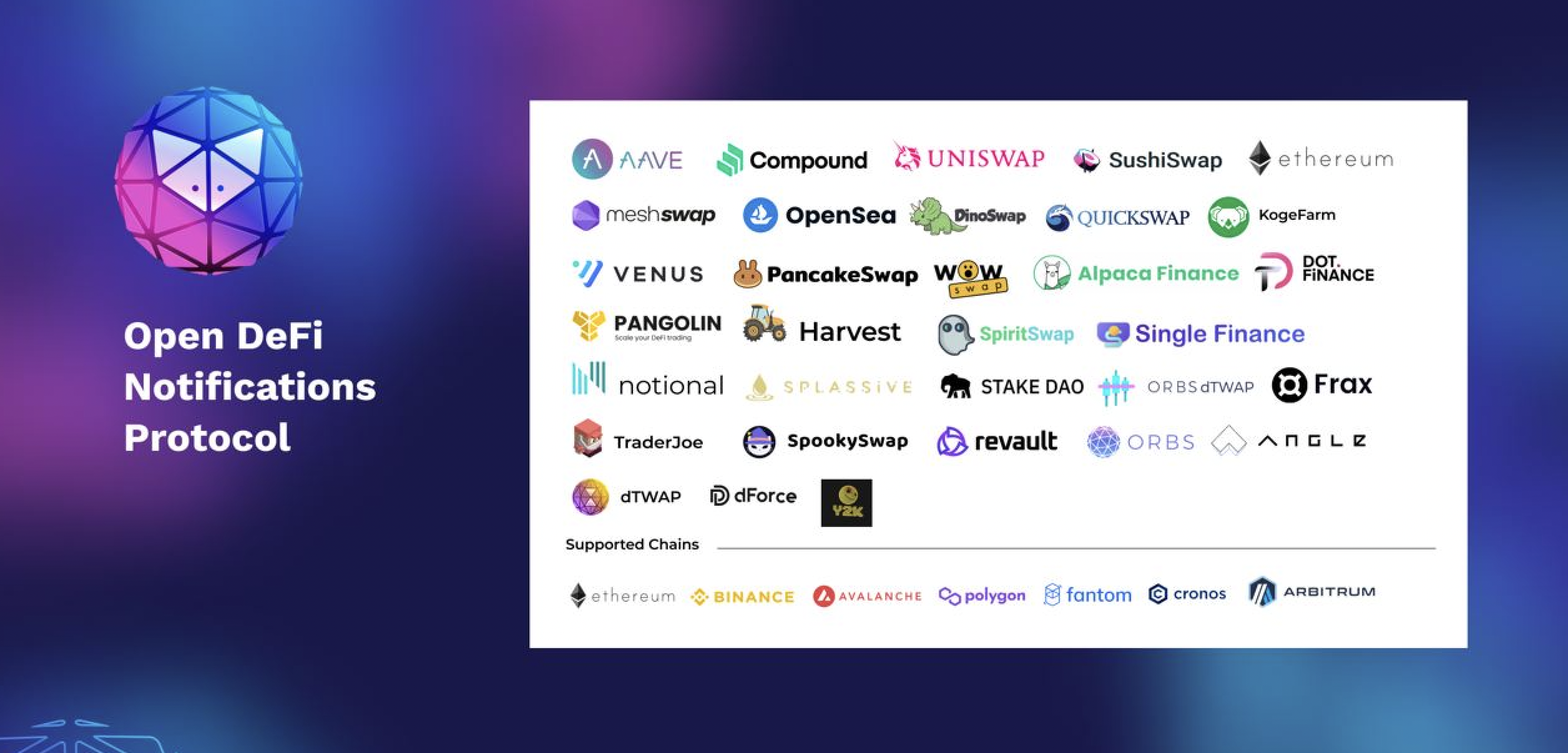

The addition of Y2K makes for an impressive lineup of leading DeFi projects who have already been integrated into the Open DeFi Notification app for the benefit of their users, including among others: Aave, Uniswap, SushiSwap, QuickSwap, PancakeSwap, and more…

All in all, the app supports over 20 protocols across 7 networks: Ethereum, BSC, Polygon, Fantom, Cronos, Avalanche, and Arbitrum!

The Protocol has been implemented fully by the Orbs network and will be executed by the Orbs Guardians, making this the 1st fully decentralized implementation of a notification protocol.

Become involved and contribute: https://github.com/open-defi-notification-protocol

Learn more about the Open DeFi Notification Protocol here.

Proudly born in the defi.org accelerator, join our Telegram channel for more updates!

Please Note

The Open DeFi Notification Protocol is a beta version that is still under active development, and all underlying digital assets, blockchain networks and DeFi platforms are also subject to ongoing development, and as such, the protocol or the underlying platforms:

(a) may contain bugs, errors and defects,

(b) may function improperly or be subject to periods of downtime and unavailability,

(c) may result in total or partial loss or corruption of data or a delay or a failure to send or receive expected notifications.

Any use of any platform, application and/or services described here is at your own risk and you are solely responsible for all transaction decisions. For more information, please see the Terms of Use and Privacy Policy.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.