There has been a lot of talk about inflation for quite some time, not only in the US but also in other leading markets. The spur in overall US CPI started in April (4.2%), later stabilized on a higher level of (5.0-5.4% during May-September), and reached its highest level of more than 30 years in October (6.2%). Similar trends occur in Germany (4.5%), GB (3.8%) and China (1.5%). In light of this, it may be interesting to share some recent Ether price analyses which may broaden the reader's horizons in seeking means of preserving their portfolio value.

Before we begin, a quick recap of some Economics 101. Inflation measures the relative change in prices of a selected basket of consumer goods and services over time, which combined together comprise the Consumer Price Index (CPI). Put differently, it indicates how much our money has devalued during a certain time period, whether year or a month. In most countries today, the central bank is in charge of applying monetary policy in order to meet the inflation target that was predefined. Usually, this target ranges between 1% to 3% per annum, though it may vary. While being one of the most important indicators of a market's stability, it is not the only one. Therefore, when analyzing a certain market other factors should be taken into consideration, among which for example are GDP, growth, and employment rate.

One of the key monetary instruments to control inflation is the central bank's interest rate. A higher inflation means prices are increasing. This usually happens when demand is higher than supply. Hence, decreasing demand should be the first step towards decreasing inflation. As the interest rate is regarded as the price of money, making it more expensive may encourage consumers to spend less and save more money. However, the other side of a higher interest rate is that credit becomes more expensive, which might slow or even stop new investments, and therefore dampen growth. This is very much an oversimplified analysis which overlooks key additional factors that influence consumers expectations, their actions, and therefore markets. But it highlights the fact that economics is not an exact science and every measure taken by policy makers might turn out to be a double-edged sword.

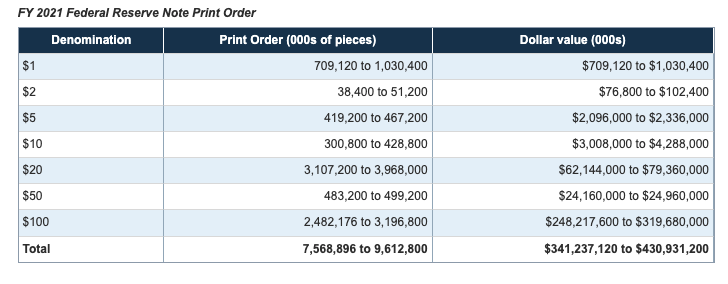

Recent inflation rates have been attributed to multiple factors related to COVID. A key factor was the Fed's accelerated money printing during 2021, expected to reach $340-430b, compared to "only" $146b in 2020. Additional factors are the ongoing global supply chain problems that have sharply decreased the supply of multiple goods, metals, chips, consumer goods, etc. In parallel, cautious consumer optimism for the end of COVID-19 (prior to Omicron's arrival) spurred demand. Again, these two are probably the two most obvious factors and fail to provide a full explanation. Still, they are both direct causes for increased price levels.

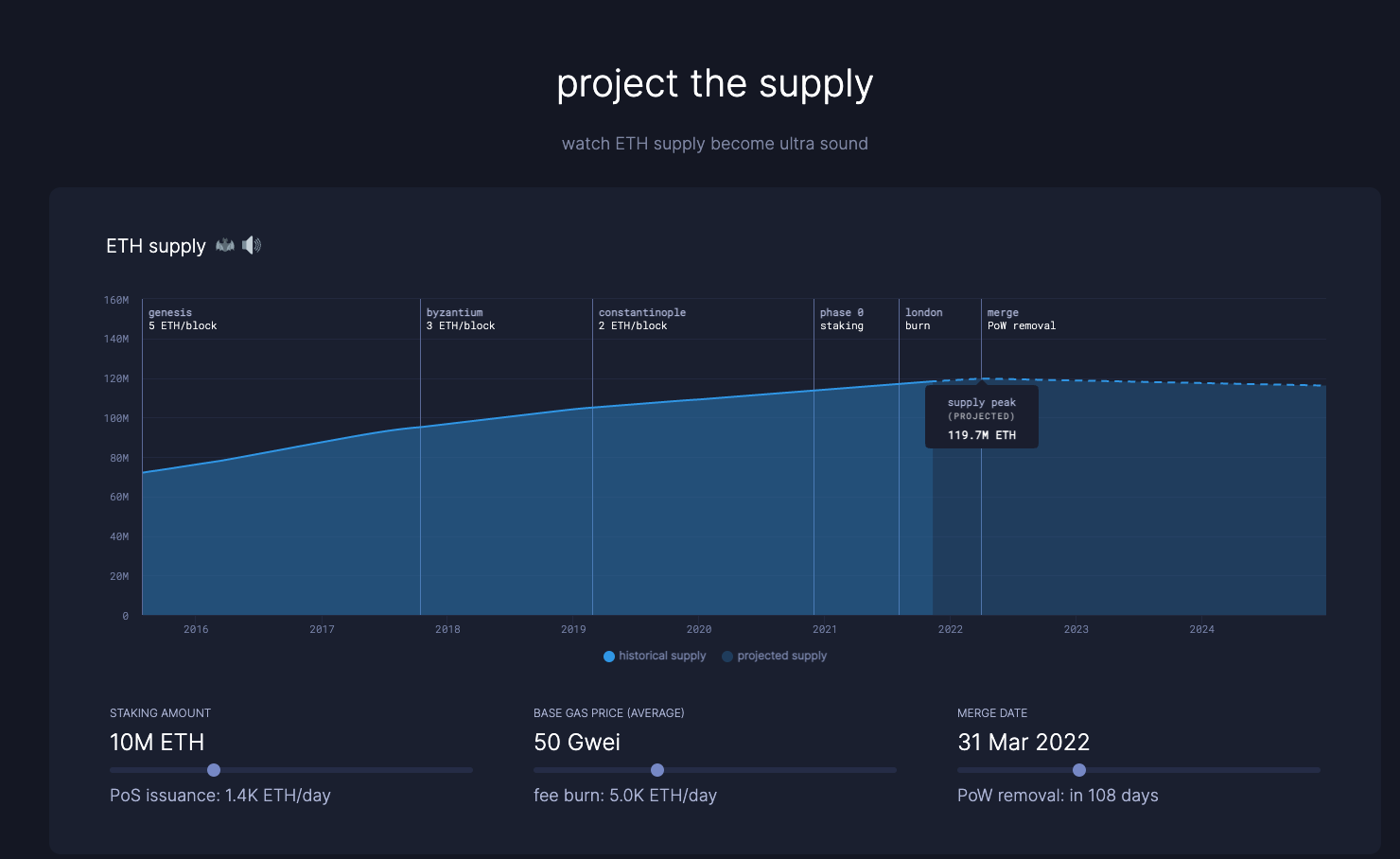

Which brings us back to Ethereum. The recent EIP-1559 update was designed to make Ether transactions more efficient by burning part of the fee (base fee, i.e., the predetermined transaction price of the Ethereum network), leaving the rest (the tips) as a gas fee, and hopefully resulting in decreasing transaction fee volatility. Following its deployment last August, it resulted in a net decrease during almost 800 blocks, as the amount of Ether burned was greater than the mining fee. Which means that during this time period the theoretical possibility of Ether becoming a deflationary asset materialized. Deflationary assets are assets whose supply decreases over time. As of writing these lines, Ether's daily issuance is around 13,000. Ether remained deflationary only for a short period, and it hasn't occurred since, though as we have seen it is an option going forward.

Source: https://ultrasound.money/

There are two interesting analyses of Ethereum which I recommend to review in detail, but I will briefly summarize here:

The first one, by Nilo Orlandi, Founder at Bubble-Gurgle, focuses on expected Ether supply. This analysis is based on the Inelastic Market Hypothesis, that assumes, in a nutshell, that overall value invested in certain assets will not change. The author then analyzes past Bitcoin halving events, and their effects on its price to prove that this market is indeed inelastic. Extrapolating that to Ether, and taking into account the "shock" of decreased supply, yields the conclusion that its price will increase substantially.

The second one, Data Always, believes that Ether's performance is essentially different then that of Bitcoin, and therefore requires a different model to forecast demand. Similarly to the first analysis, it also predicts a sharp decrease in Ether supply, in addition to Ether turning deflationary. Moreover, it focuses on a trajectory of growing demand trends that will result in an even greater appreciation of Ether price. It further takes into account the effects of various amounts of staked Ether for improved prediction accuracy.

Readers of our posts know that most of what we publish revolves around blockchain and its potential social impact. This one is clearly different, and it is because there has never before existed a real deflationary asset, and I find it fascinating that we may be witnessing the very first of its kind in ETH. I figured it would be refreshing to discuss recent macroeconomic trends, combined with some hardcore technical analyses. With cryptocurrency, consumers have new exciting options to hedge against inflation. Reiterating the disclaimer I opened with, I do not wish to recommend to anyone how to manage their own portfolio, but show some things that I consider, while optimizing mine.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.