dTWAP powered by Orbs is a fully decentralized, permissionless, and composable DeFi protocol, developed by the Orbs team and powered by the Orbs network. By integrating the dTWAP protocol, SpiritSwap is the first DEX-AMM to introduce decentralized advanced trading orders to the DeFi space.

Even though TWAP is considered an advanced algorithmic trading order (especially in comparison to basic “swap” and “limit” orders), using this order type is relatively simple, as we’ll demonstrate shortly. All in all, traders should not be discouraged from taking advantage of this powerful tool to optimize their trading and reduce their order’s price impact on the market.

In this blog post we’ll cover the fundamentals of a dTWAP order, how to set up the order on the SpiritSwap UI, monitoring open orders, and more…

dTWAP (Decentralized Time-Weighted Average Price) is a common algorithmic trading executing strategy that seeks to minimize a large order’s impact on the market by dividing it into a number of smaller trades and executing these trades at regular intervals over a specified period of time.

Using the dTWAP order, SpiritSwap’s users can now optimize their trading by executing more sophisticated trading strategies. These include, among other things, the ability to significantly reduce price impact when executing large orders or in cases of fragmented and low liquidity, automation of Dollar-Cost Averaging (DCA), and more.

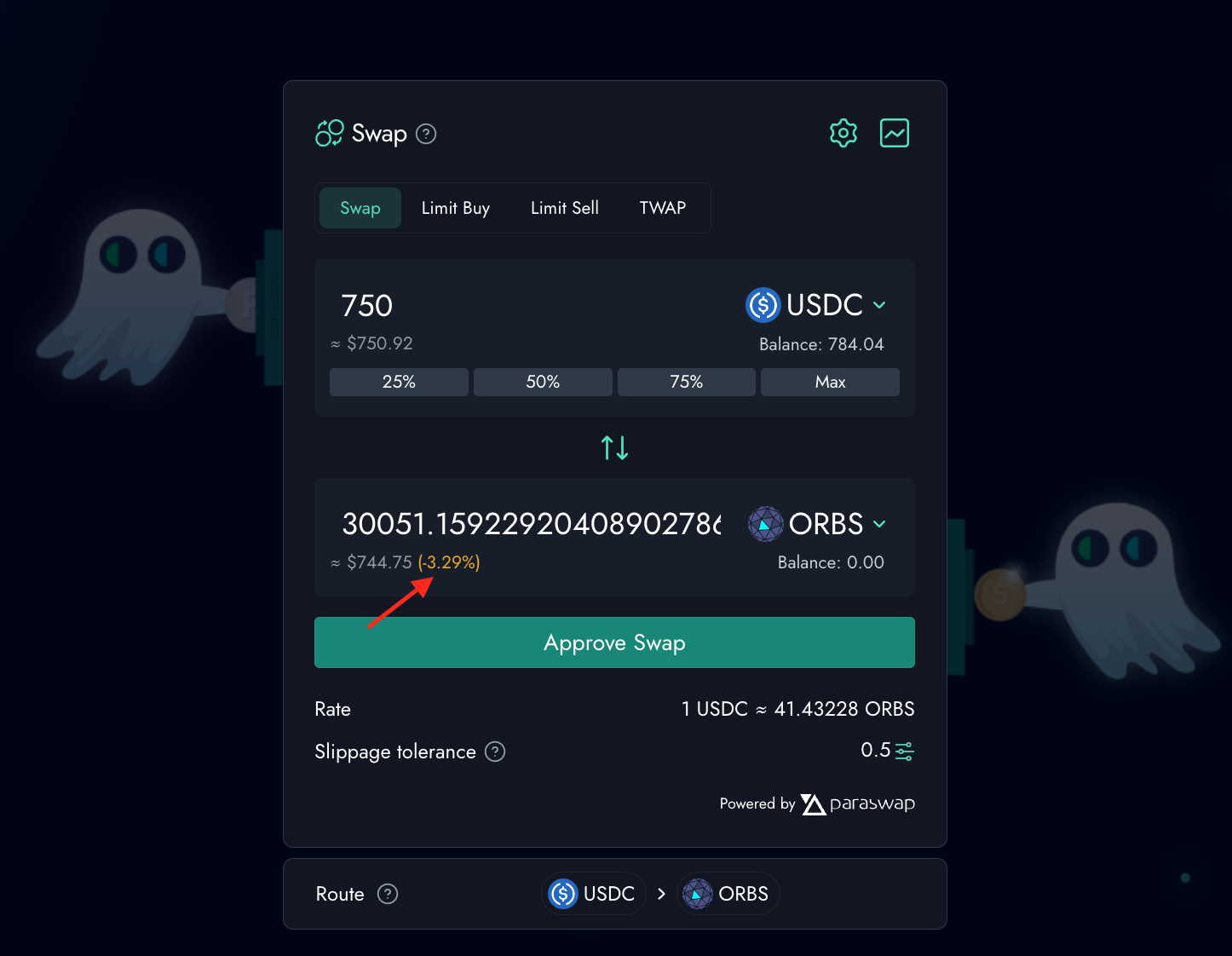

In this tutorial, we wish to swap $750 USDC tokens to ORBS tokens.

If we were to execute this trade using a swap order, we would have created a big price impact of -3.29%! Obviously this is unacceptable.

Let’s see how dTWAP can mitigate this and significantly reduce our trade’s price impact -

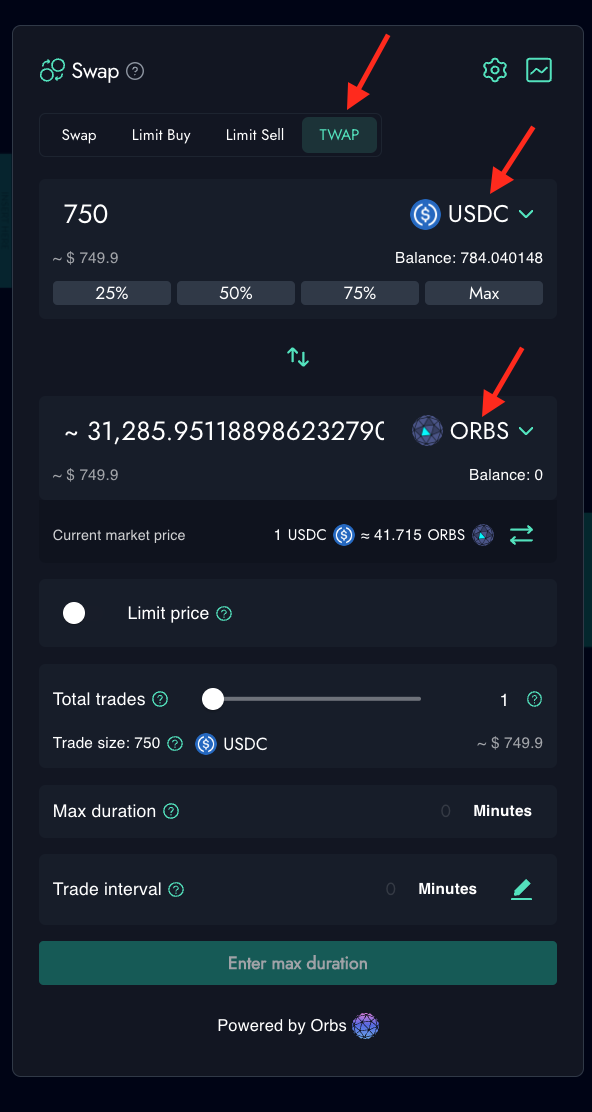

1. Choose From/to Tokens

The dTWAP order can be accessed from the Swap Page in the SpiritSwap application. As with any order, the first step is to specify your source (USDC) and destination (ORBS) tokens to be traded.

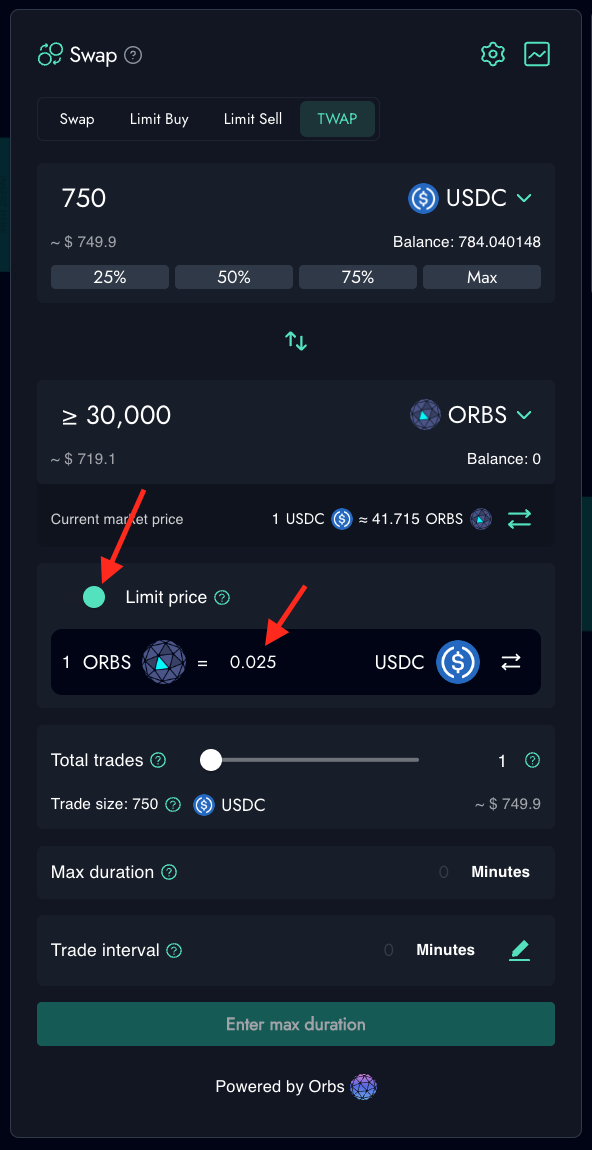

2. Limit Price?

The next step is to decide if you want to make a “market” order or a “limit” order.

Users have the option to add a “limit price”, thereby turning their order into a limit order. If this option is not selected, the default is a market order with no constraint as to what price trades may execute.

In this example, we will specify a limit price of $0.025 ORBS, which means that the dTWAP protocol will execute trades only if the ORBS price is equal or better than $0.025.

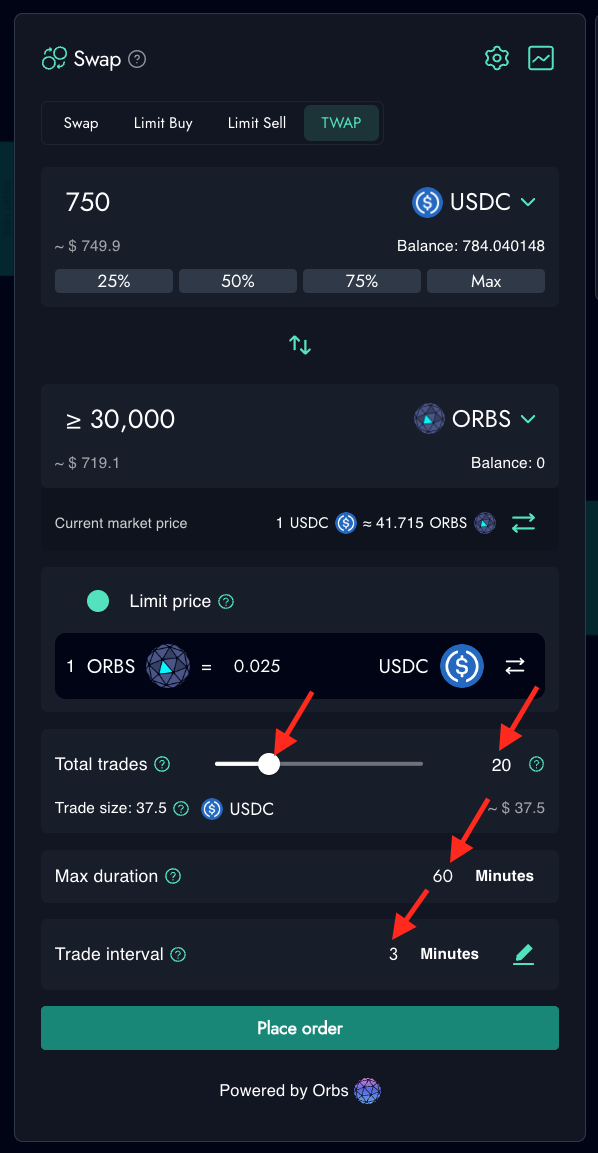

3. Specify dTWAP parameters

The dTWAP UI has 3 basic parameters which the user needs to specify:

These parameters allow for a lot of flexibility for the user when placing the order, taking into account factors such as market conditions, current gas fees, etc.

In our example we’ll specify the following parameters:

This means that the dTWAP order will break our trade into 20 individual swap orders of $37.5 USDC each, executed at regular intervals of 3 minutes.

In this way, the price impact of each individual trade is much lower than the full trade size. In addition, the interval between trades gives arbitrageurs a sufficient time window to close any price discrepancies on the affected pools and bring the reserves back to equilibrium (on par with spot price).

Note that, due to market fluctuations,the number of Orbs tokens received in return for the 37.5 USDC output may be different in each of the 20 trades.

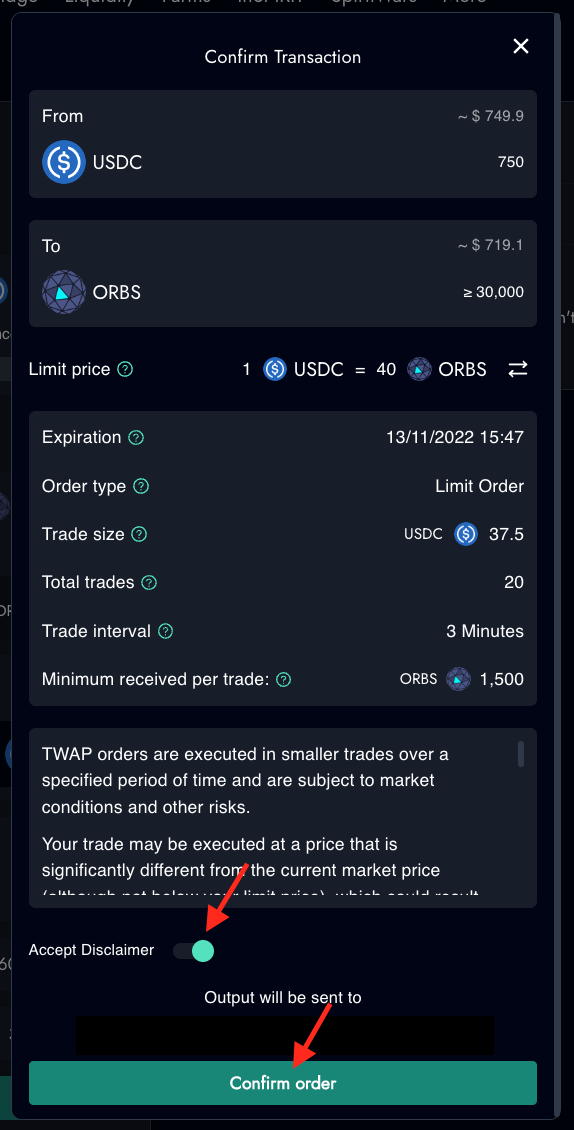

4. Confirm to Execute

Once all of the above fields have been filled in - your order is ready to be executed!

Press the “Place Order” button at the bottom of the screen and a pop-up window will emerge with the trade details summary. Once reviewed, confirm the trade and sign the transaction with your crypto wallet (such as Metamask).

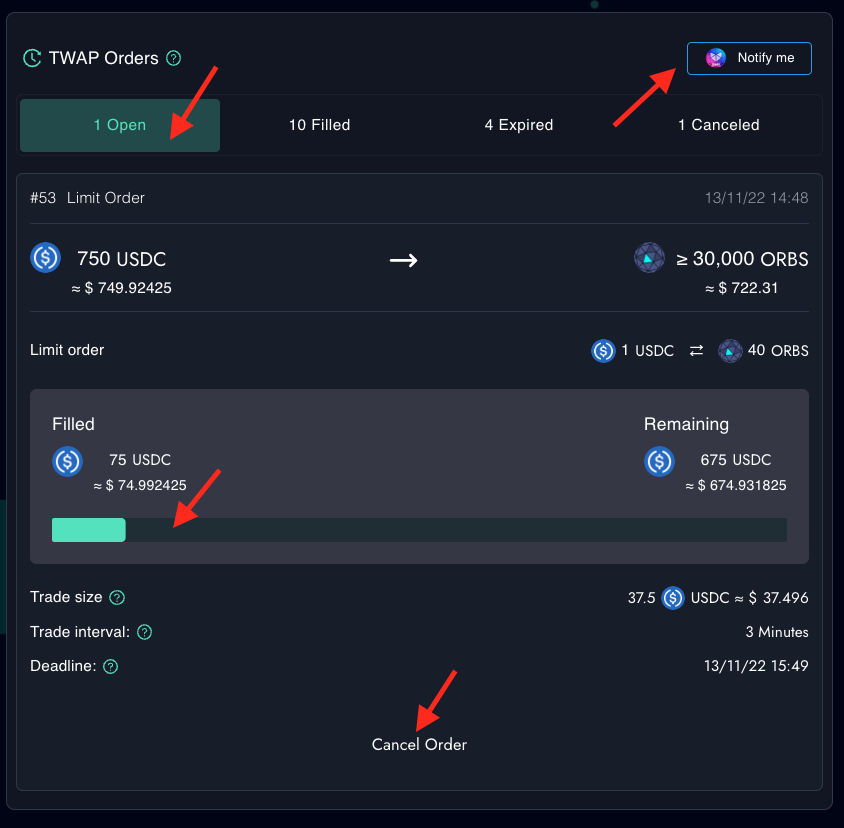

Users can continuously monitor their Open/Filled/Expired/Canceled dTWAP orders status in the SpiritSwap UI. Open orders can be canceled at any time by the user.

Users can also set up free, on-chain mobile notifications using the Open DeFi Notification Protocol powered by Orbs, for real-time notifications of their dTWAP order status.

The Orbs Network is an open, decentralized and public blockchain infrastructure executed by a secure network of permissionless validators (known as “Guardians”) using Proof-of-Stake (PoS) consensus. Orbs is optimized to provide “L3” services, working in conjunction with existing L1 and L2 layers and acting as a “decentralized backend” that enhances the capabilities of EVM smart contracts. Orbs Network mainnet is live since 2019 and has dozens of active validators staked with over $100M.

The network provides its L3 services by operating as a decentralized serverless cloud that allows developers to design applications that extend the capabilities of their smart contracts without relying on traditional centralized server solutions. These applications are deployed to be executed by the Orbs Guardians in a decentralized way.

As part of the dTWAP protocol, Orbs Guardians will run a tailored function that acts as the single honest bidder that is required for the dTWAP protocol to run optimally and achieve prices that track the spot market price as closely as possible. The orders sent from the SpiritSwap UI will then be executed in a decentralized manner with the participation of the Orbs Network’s Guardians, who act as an honest bidder to ensure that the dTWAP orders are executed at an optimal price and at a fair fee (gas costs only).

Using dTWAP incurs no additional trading fees other than gas costs and the usual fees taken by SpiritSwap.

About Orbs

The Orbs Network is an open, decentralized and public blockchain infrastructure executed by a secure network of permissionless validators using Proof-of-Stake (PoS) consensus.

Orbs is set up as a separate decentralized execution layer operating between existing L1/L2 solutions and the application layer, as part of a tiered blockchain stack, without moving liquidity onto a new chain. Orbs acts as a “decentralized backend”, enhancing the capabilities of existing smart contracts and opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs and GameFi.

Orbs was founded in 2017 and launched its mainnet and token in March of 2019. Orbs is being developed by a dedicated team of more than 30 people, with offices in Tel Aviv, London, New York, Tokyo and Seoul.

For more information, please visit www.orbs.com, or join our community at:

Telegram: https://t.me/OrbsNetwork

Twitter: https://twitter.com/orbs_network

Learn more about Orbs

Disclaimer

TWAP orders are executed in smaller trades over a specified period of time and are subject to market conditions and other risks.

Your trade may be executed at a price that is significantly different from the current market price (although not below your limit price), which could result in significant losses. If the available market price is lower than the limit price you have set, some of the trades of your TWAP order may not be executed, resulting in a partially filled order.

The TWAP trades are based on a decentralized TWAP protocol that utilizes off-chain takers which compete to fill orders. These takers are entitled to request a fee, which the protocol removes for the winning taker from the output tokens. Accordingly, the amount of output tokens you will receive may vary in accordance with taker behavior.

Takers may take into account gas fees for your transactions when setting their fees, which may result in fluctuations in the fee amounts.

Note that the protocol has been designed such that the presence of one honest taker (i.e, a taker who charges only reimbursement for gas fees) should result in an output amount that is as close as possible to spot market prices. SpiritSwap and Orbs have implemented automated, decentralized “honest takers”, however, these features are in beta and their use is subject to risk.

This TWAP order will be executed using a decentralized protocol that is in beta and its use is at your own risk. You can read more about the TWAP protocol here.

Use of this feature is subject to the terms and conditions set forth here.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.