Orbs is thrilled to introduce dSLTP - the first-ever decentralized stop order protocol for DEXs. Built on Orbs’ Layer-3 (L3) infrastructure, dSLTP brings reliable, robust, and efficient stop-loss and take-profit execution to decentralized trading, all without compromising security and decentralization.

dSLTP joins the Orbs Advanced Trading Orders Suite, alongside dLIMIT and dTWAP, expanding DeFi’s capabilities with CeFi-grade trading features.

Stop orders are critical tools for strategic trading and risk management. They help traders:

A stop-loss order automatically sells a token once its price drops below a predefined level, helping traders limit losses in volatile markets. Stop-loss orders are essential in fast-moving markets, offering peace of mind and protection when the market turns against you.

A take-profit order automatically sells once the price reaches your target profit level.

When used together, stop-loss and take-profit create a balanced risk/reward strategy — maximizing upside while controlling downside exposure.

Until now, such tools were primarily available only on CEXs. With dSLTP, this changes — making advanced order automation accessible directly on DEXs.

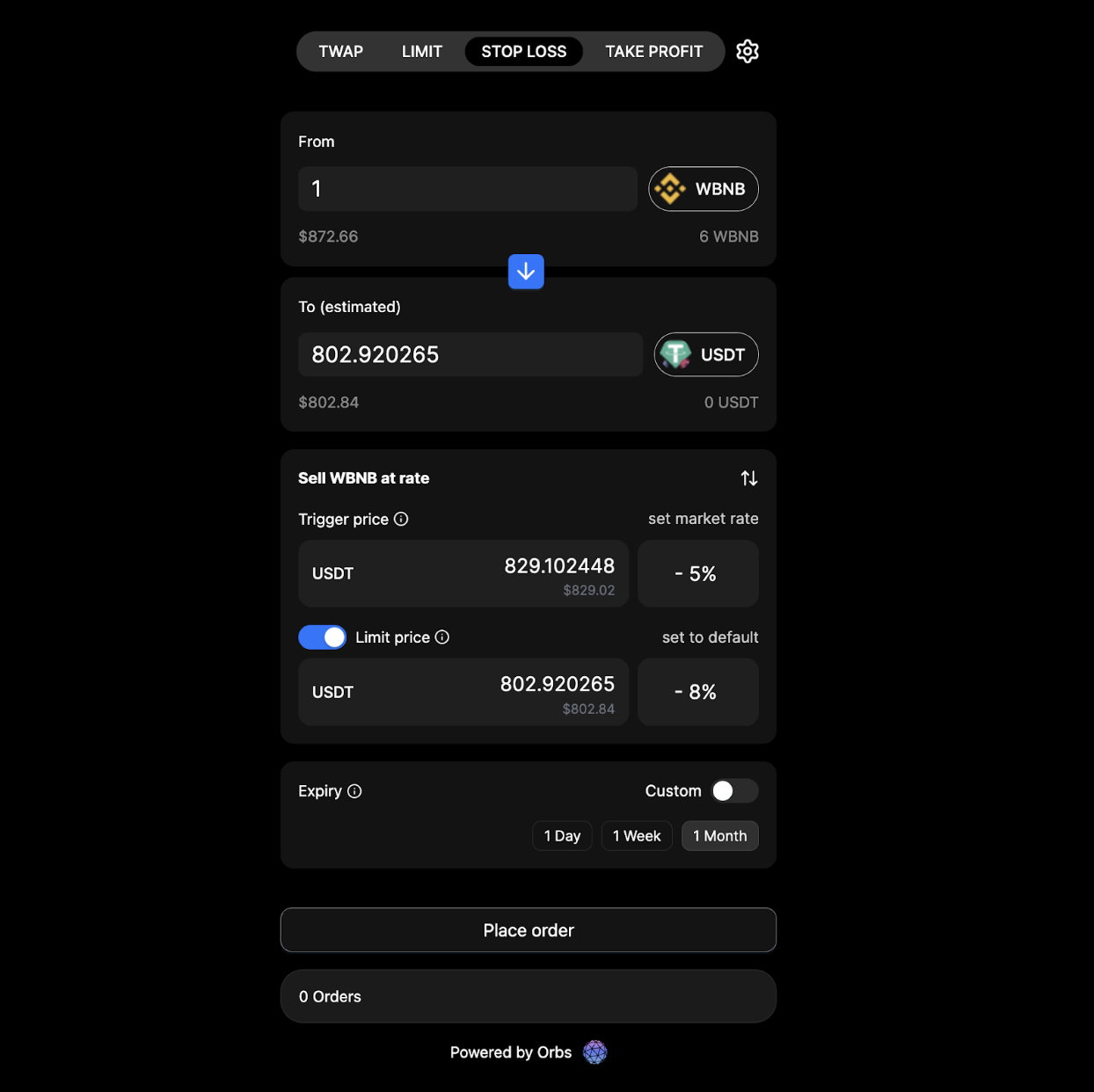

dStopLoss comes with a specialized UI that can be easily integrated and customized by any DEX, to create an intuitive, user-friendly and informative way for users to set up their stop orders.

dSLTP supports both stop-market and stop-limit orders, giving the users the ability to set up the optimal configuration that suits their need:

For more information on how to set up a stop-order, see the dSLTP documentation and FAQ page, or visit the dSLTP telegram support group.

Orbs is a decentralized Layer-3 (L3) blockchain designed specifically for advanced on-chain trading. Utilizing a Proof-of-Stake consensus, Orbs acts as a supplementary execution layer, facilitating complex logic and scripts beyond the native functionalities of smart contracts. Orbs-powered protocols, including dLIMIT, dTWAP, Liquidity Hub, and Perpetual Hub, push the boundaries of DeFi by introducing CeFi-level execution to on-chain trading.

With a global team of over forty dedicated contributors based in Tel Aviv, London, New York, Tokyo, Seoul, Lisbon, and Limassol, Orbs continues to innovate at the forefront of blockchain technology.

For more information, visit www.orbs.com or join our community:

Telegram: https://t.me/OrbsNetwork

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.