Orbs Liquidity Hub continues to optimize decentralized finance (DeFi) liquidity with the integration of Lumia, a next-generation hyper-liquid zkEVM solution designed to enhance trade execution and liquidity aggregation. Fragmented liquidity across multiple chains remains a significant challenge in DeFi, causing inefficiencies such as slippage and higher costs for traders. Lumia joins a robust group of solvers already contributing to Liquidity Hub, including Odos, ParaSwap, OpenOcean, KyberSwap, private liquidity, and many more, each playing an important role in addressing these challenges.

Lumia’s integration adds to a powerful on-chain solver auction system, where solvers compete to fulfill trade orders by drawing liquidity from diverse sources, including AMM pools, cross-chain, and off-chain reserves. This dynamic ensures that trades are executed at better prices, surpassing traditional DEX-AMM models. By doing so, Orbs Liquidity Hub further strengthens its ability to enable DEXs to aggregate liquidity from anywhere, delivering optimal pricing without manual liquidity sourcing.

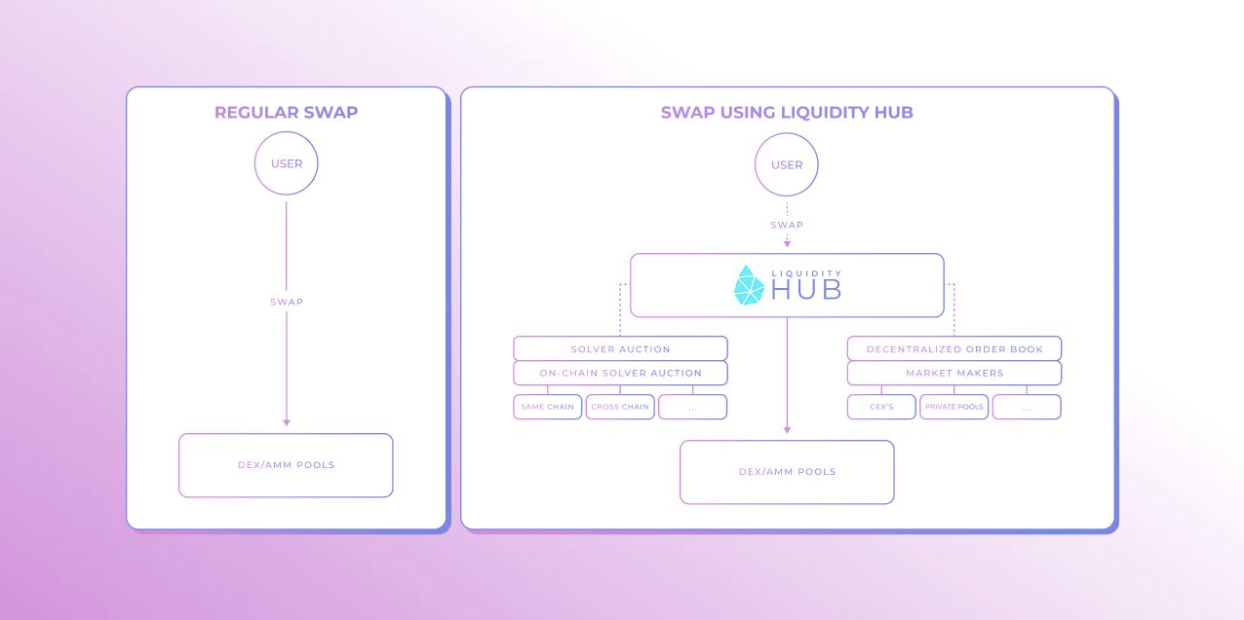

Liquidity Hub is an Orbs layer 3 (L3) powered meta aggregator that provides an optimization layer above the AMM. This technology taps external liquidity for better price quotes and lower price impact.

Instead of the typical swap that searches for the best route within the DEX's limited liquidity pools, Liquidity Hub enhances this process by utilizing additional liquidity sources:

On-chain solver auction: Third-party solvers who compete to fill swaps using on-chain liquidity like AMM pools or their private inventory.

Decentralized orders via API: Decentralized orders are accessible using API, enabling institutional/professional traders, such as market makers, to submit bids and compete to fill swaps.

Liquidity Hub allows DEXs to attempt to execute trades without going through the AMM and experiencing price impact. If the layer cannot execute the trade at a better price than the AMM, the transaction will return to the AMM contract and execute as usual.

About Lumia

Lumia is the first next-gen, ultra capital-efficient, hyper-liquid zkEVM solution, utilizing a cutting-edge tech stack: PolygonCDK, AvailDA as well as redundancy DA thanks to its DAC, Polygon AggLayer, Gevolut, Chain Abstraction, Account Abstraction, and more. These innovations are made possible through co-development efforts between GatewayFM (RaaS) and Lumia's tech team.

Lumia combines these advanced technologies to offer a secure, scalable, and hyper-liquid Web3 experience. Protocols integrated with Lumia gain access to a vast array of trade possibilities, enabling users to efficiently and securely swap thousands of tokens cross-chain with unprecedented capital efficiency.

About Orbs

Orbs is a decentralized Layer-3 (L3) blockchain specifically designed for advanced on-chain trading.

Utilizing a Proof-of-Stake consensus, Orbs acts as a supplementary execution layer, facilitating complex logic and scripts beyond the native functionalities of smart contracts. Innovative protocols like dLIMIT, dTWAP, Liquidity Hub, and Perpetual Hub push the boundaries of DeFi and smart contract technology, introducing CeFi-level execution to on-chain trading.

The project's core team comprises over thirty dedicated contributors globally from Tel Aviv, London, New York, Tokyo, Lisbon, Limassol, and Seoul.

For more information, please visit www.orbs.com, or join our community at: Telegram: https://t.me/OrbsNetwork X: https://x.com/orbs_network

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.