PancakeSwap, the leading multichain DEX, has integrated the dLimit & dTWAP protocol powered by Orbs!

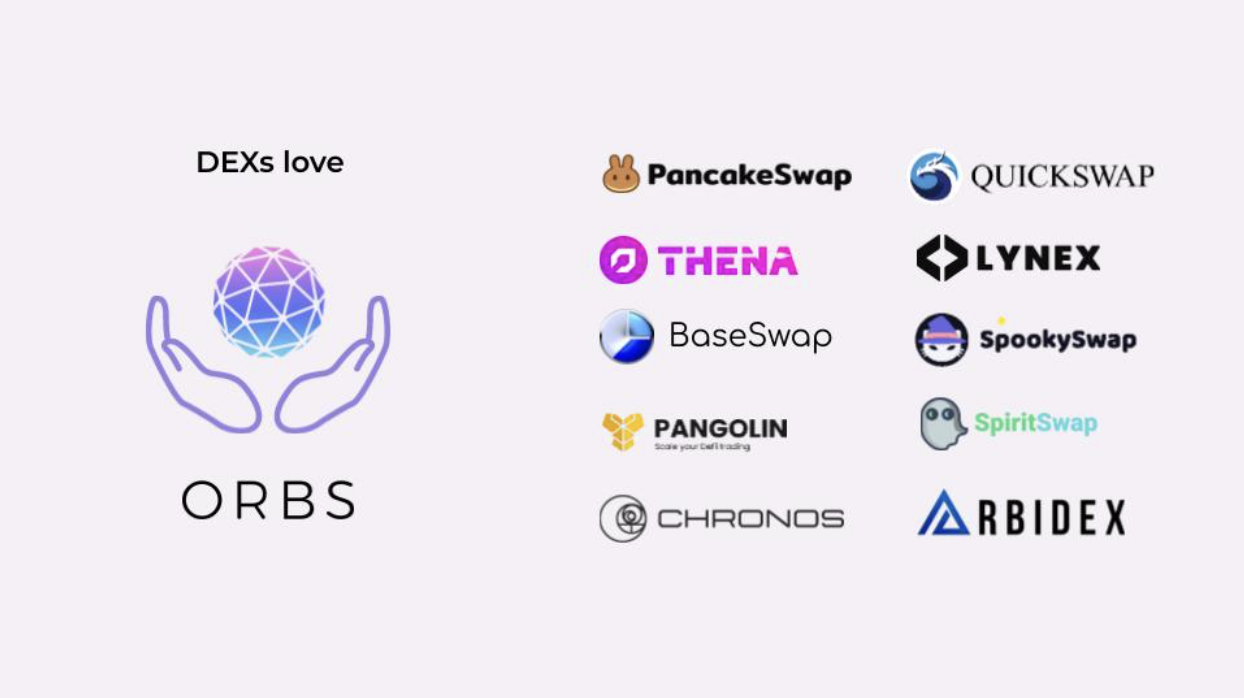

As a result, PancakeSwap traders will now have access to both advanced order types, enabling traders to guarantee the price of their orders or break up large orders into smaller trades. This development follows successful integrations with other prominent DEXs, including QuickSwap, SpookySwap, Thena, and more. With each integration, dLIMIT and dTWAP further solidify Orbs' position as a market leader in DeFi innovation, showcasing Orbs’ novel layer 3 technology for pushing the boundaries of smart contract technology.

dLIMIT is a fully decentralized, permissionless, and composable DeFi protocol developed by the Orbs team and powered by the Orbs network. PancakeSwap traders will now have access to the advanced order types at no extra cost. Furthermore, in addition to dLIMIT, PancakeSwap will also integrate decentralized time-weighted average price orders (dTWAP) by Orbs, enabling the execution of this commonly used algorithmic trading strategy.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with TVL valued at over a hundred million dollars. Orbs pioneers the concept of L3 infrastructure, by utilizing the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

In the past week, PancakeSwap supported a transaction volume of 5.9B at the time of writing. dLIMIT & dTWAP will expand the DEX’s current offerings, potentially opening up another avenue for the project to increase trading volumes.

For those who are unfamiliar, a Limit order allows users to buy or sell tokens at a specific price. While the specified price is guaranteed, the execution of the order is not and depends on price movement. Limit orders will only be executed if the market price meets the order specifications.

In contrast, a TWAP order is an algorithmic trading strategy that aims to reduce the impact of large orders on the market by breaking them down into smaller portions that are then executed over time. By executing smaller orders, this approach minimizes the price impact and gradually enables traders to acquire various assets over a specific period. In DeFi this is particularly useful as pools need time to rebalance.

PancakeSwap’s traders can utilize these key traditional finance orders without sacrificing decentralization.

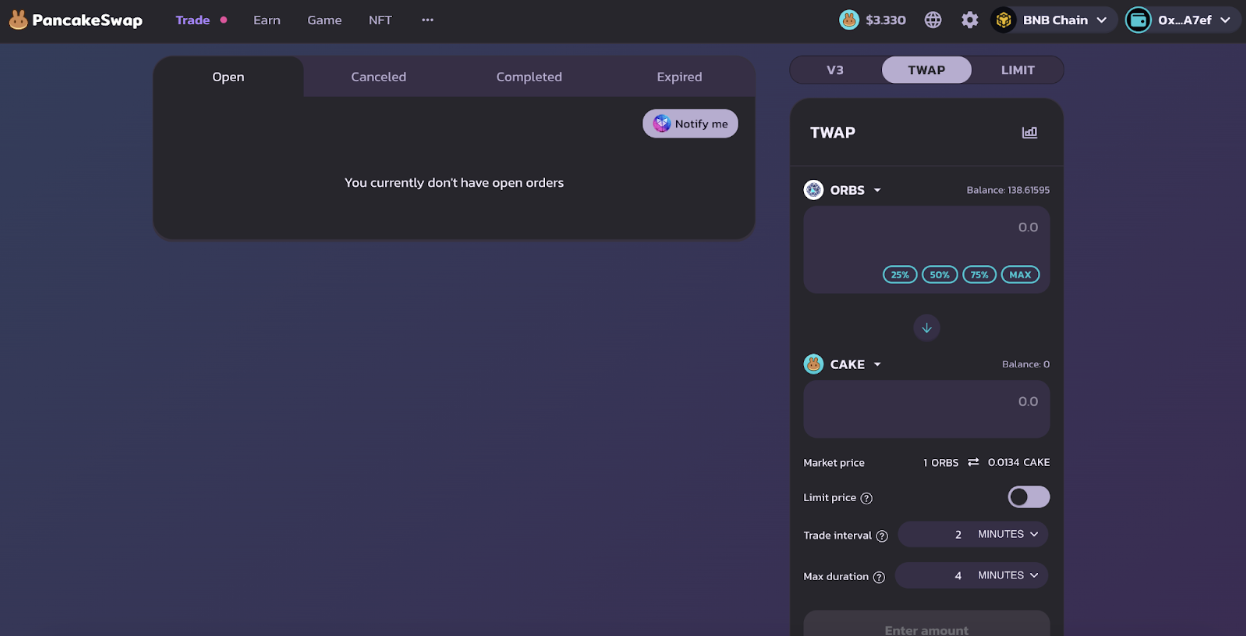

When switching to a dLIMIT ‘swap’ on PancakeSwap, users are presented with an easy-to-follow user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLIMIT order, traders must specify the following:

dLIMIT takes into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order live in the ‘order history’ tab.

For a dTWAP order, three additional parameters need to be specified:

Similarly to dLIMIT, these parameters provide incredible flexibility in customizing each order, considering factors like market conditions and current gas fees. Additionally, the UI facilitates dTWAP-market orders, which execute all trades at the available market price, and dTWAP-Limit orders, which only execute individual trades if they are within the price Limit set by the user. Once these parameters are set, the user can approve the specific source token, place the order, and confirm their specified configuration.

The dLIMIT & dTWAP protocol, powered by Orbs L3 technology, has become the industry standard for decentralized algorithmic orders in DeFi. The ‘powered by Orbs branding’ has become a staple of confidence when executing advance orders on decentralized venues.

The protocol has been implemented by 10 prominent DEXs spanning 6 chains, facilitating over 40 million dollars of trading volume.

Join the support Telegram channel for more information regarding both advanced order types.

Find out more info:

About PancakeSwap

PancakeSwap is a leading multichain decentralized exchange that operates on an automated market maker (AMM) model built on BNB Chain, Ethereum, Aptos, Polygon zkEVM, Linea, zkSync Era, Base, Arbitrum One and opBNB. Launched in 2020, Pancakeswap is one of the most popular DEXs in the cryptocurrency industry due to it’s low transaction fees, high-speed trading and user-friendly platform. PancakeSwap has over $700 billion in total trading volume and over $1.8 billion in total liquidity locked, making it the leading multichain DEX in the industry. For more information, visit https://pancakeswap.finance/.

About Orbs

Orbs is a "Layer-3" public blockchain infrastructure project powered by PoS, pioneering on-chain innovation since 2017.

Orbs is set up as a separate execution layer between L1/L2 solutions and the application layer, as part of a tiered blockchain stack, enhancing the capabilities of smart contracts and powering protocols such as dLIMIT, dTWAP, and Liquidity Hub.

The project's core team consists of more than thirty dedicated contributors spanning from Tel Aviv, London, New York, Tokyo, and Seoul.

For more information, please visit www.orbs.com, or join our community at:

Telegram: https://t.me/OrbsNetwork

Twitter: https://twitter.com/orbs_network

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.