Following up on the initial dTWAP announcement blog, and the dLIMIT intro blog, QuickSwap has now also integrated dLIMIT powered by Orbs. In doing so, all of the limit orders on QuickSwap will now be executed using Orbs’ layer-3 technology. The integration furthers Orbs as a market leader in DeFI technology innovation and gives the project another L3 use case that interacts with significant TVL.

For those unfamiliar with QuickSwap, it is the largest native DEX on Polygon, facilitating a 7-day volume of over 188 million dollars. Polygon at the time of writing is the fourth highest volume chain only below Ethereum, Arbitrum, and Binance Smart Chain.

The integration highlights the close technical collaboration between Orbs and QuickSwap with both projects actively contributing to making dLIMIT a reality on the DEX. The integration was preceded by a Snapshot governance vote by the QuickSwap’s community, which was passed by a landslide decision to proceed with the integration.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with TVL valued at over a hundred million dollars. Orbs pioneers the concept of L3 infrastructure, by utilizing the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

In the past week, QuickSwap has supported a transaction volume of $188 million dollars at the time of writing with another 143 million in TVL. QuickSwap’s offerings include multi-chain swaps, order, and ‘best price trades’. Now dTWAP and dLIMIT are supported via Orbs, allowing the DEX to attract higher volumes and more sophisticated traders.

A limit order enables users to buy or sell tokens at a specified price or better. While the price is automated, the order being executed is not - Limit orders will be executed only if the price meets the order qualifications.

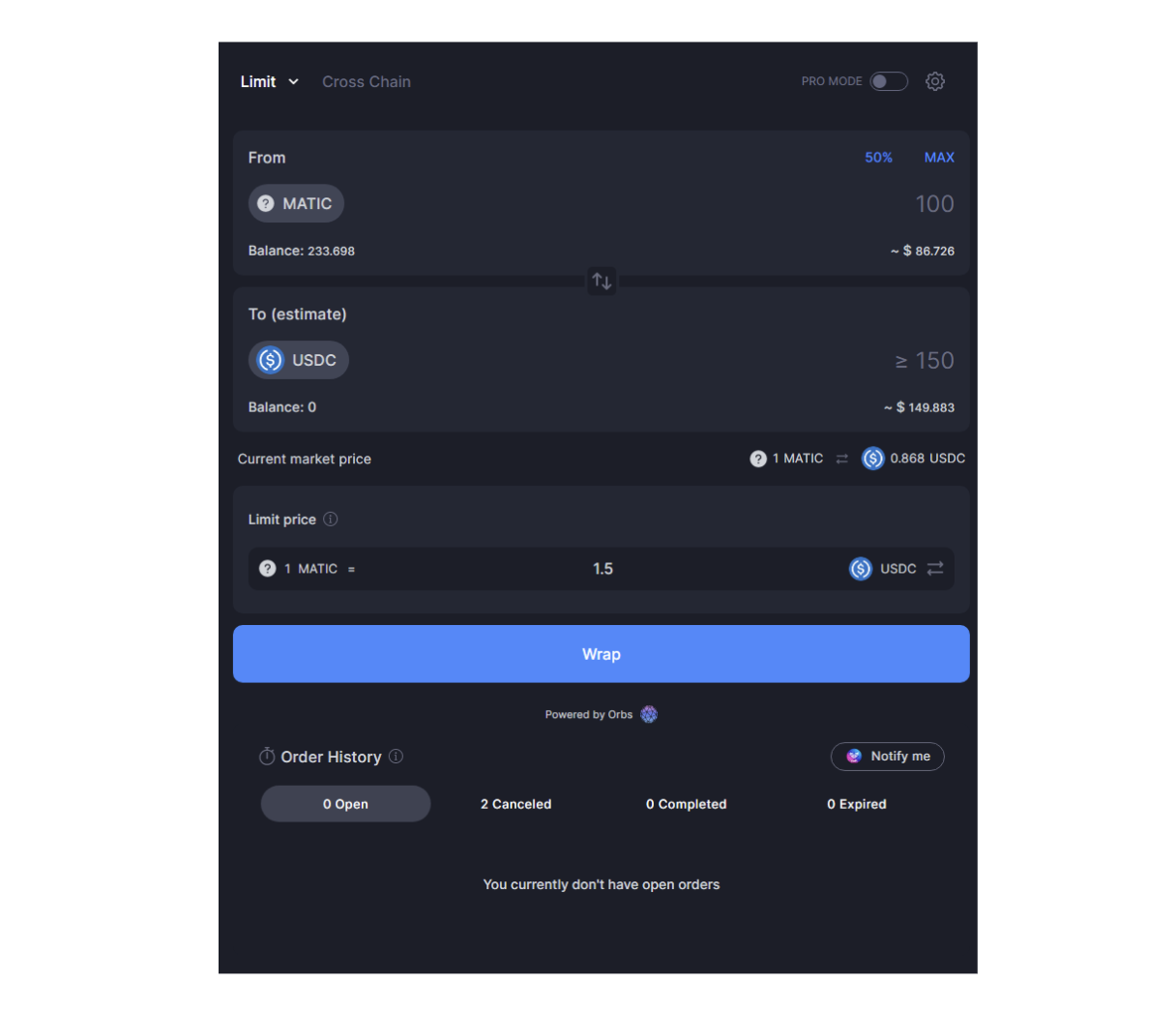

When switching to the dLIMIT trade order on QuickSwap’s UI, users are presented with a seamless user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLMIT order, traders must specify the following:

dLIMIT configuration is simple, albeit robust taking into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order live in the ‘order history’ tab.

For example, in the screenshot above, the user would like to sell 100 MATIC to USDC. The current market price of MATIC is 0.868 USDC. The user specifies a limit price of 1.5 USDC, meaning that the order will be executed when MATIC reaches a price equal to, or above, 1.5 USDC, giving him an estimated output of >=150 USDC.

Powered by the Orbs network L3 technology, the dTWAP and dLIMIT protocol has established itself as the standard in the DeFi space for decentralized algorithmic orders. With integrations on 4 DEXs across 3 different chains, which combined have facilitated a $200M+ trading volume in the past seven days, the protocol usage is expected to grow substantially as it expands support for additional DEXs. In the coming weeks, expect more updates on further collaboration between Orbs and Quickswap.

For more information regarding the dTWAP and dLIMIT protocol, join the Telegram channel support group.

About Orbs

The Orbs Network is an open, decentralized, public blockchain infrastructure executed by a secure network of permissionless validators using Proof-of-Stake (PoS) consensus.

Orbs is a separate decentralized execution layer operating between existing L1/L2 solutions and the application layer, as part of a tiered blockchain stack, without moving liquidity onto a new chain. Orbs acts as a “decentralized backend”, enhancing the capabilities of existing smart contracts and opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

Orbs was founded in 2017 and launched its mainnet and token in March of 2019. Orbs is being developed by a dedicated team of more than 30 people, with offices in Tel Aviv, London, New York, Tokyo, and Seoul.

For more information, please visit www.orbs.com, or join our community at:

Telegram: https://t.me/OrbsNetwork

Twitter: https://twitter.com/orbs_network

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.