In light of the skyrocketing popularity of DeFi (Orbs followers know that the project has been focused on unlocking the potential of Orbs in the DeFi space), the latest step forward for the Orbs ecosystem is integrating ORBS tokens with Solana's leading DeFi ecosystem - one of the most productive DeFi ecosystems in the crypto-verse at the moment.

After successfully bridging the ORBS token via Solana's Wormhole cross-chain bridge and going live on Raydium, we're excited to announce that Orbs is now available on Serum, thus further expanding its ecosystem.

Serum is a protocol and ecosystem built on Solana that brings speed and affordable transaction costs to decentralized finance. Serum ecosystem partners can compose with Serum's on-chain central limit order book to share liquidity and power markets-based features.

More specifically, Serum's on-chain central limit order book and matching engine provides liquidity and price-time-priority matching to traders and composing projects. Users may take advantage of this exchange model through the ability to choose the price, size and direction of their trades. Composing projects can benefit from Serum's architecture, liquidity, and matching service.

Let's take a closer look at Raydium and deeper explore its connection to Serum. Raydium is an automated market maker (AMM) built on the Solana blockchain for the Serum Decentralized Exchange (DEX). Raydium's major goal is to bring new and existing projects looking to grow and expand to Solana and Serum ecosystems. Having first-mover's advantage as an AMM, Raydium provides an opportunity for token owners to earn fees by giving liquidity. Raydium LPs thought to get access to the entire order flow and liquidity of Serum. Moreover, Raydium's platform enables swapping and trading to earn yield on digital assets. Thus, we can think of Raydium as a bridge between Serum and a wide range of projects looking for further growth opportunities.

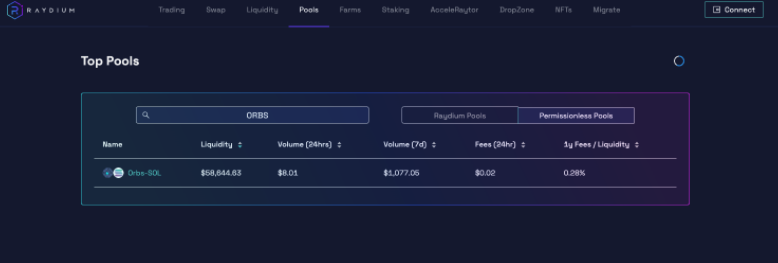

Now, you can add liquidity to Orbs pool which is currently available on Raydium for ORBS-SOL, with a total liquidity of ~$58K. In return for adding liquidity, you will receive trading fees for that pair, and LP Tokens that you may stake elsewhere to earn additional rewards. You can read more here.

The Serum project intends to solve the swapping issues that cross-chain DeFi is currently facing. In general, despite being on Solana and having the speed and cost that go along with that, Serum is also fully usable from Ethereum. This means that existing DeFi projects can access Serum's features and liquidity directly from their native blockchain, creating fast integration between the current infrastructure and Serum.

Orbs is excited to further expand the list of successful integrations on the Solana network, exploring the possibilities and opportunities it presents.

For the latest updates, join the official Orbs Telegram group.

Please Note

Use of the Raydium, Wormhole, Serum DEX and the other platforms and services described above carries significant risk. Such risks may include lack of stability or other technical issues resulting from upgrades of the Solana blockchain to a new version or the launch of its non-beta MainNet. Digital assets, decentralized finance products are, by their nature, highly risky, experimental and volatile. Such platforms and services may be subject to security and economic risks and exploits and transactions may be irreversible, final and without refunds. Such use carries risk of substantial losses.

Any use of any platform, application and/or services described above is at your own risk and you are solely responsible for all transaction decisions. You should do your own research and independently review any third party services and platforms and any applicable information terms, conditions or policies applicable to such platforms and services.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.