TL;DR

dTWAP by Orbs is a fully decentralized, permissionless, and composable DeFi protocol, developed by the Orbs team and powered by the Orbs network. By integrating the dTWAP protocol, SpiritSwap is the first DEX-AMM to introduce advanced trading orders in the DeFi space.

This achievement results from a comprehensive review and due-diligence process by the Spirit community, including: DAO governance vote, smart contract audits (1,2), code review by the Spirit team, and more. The Orbs project is proud to be a contributor to the SpiritSwap protocol, bringing innovation into the Spirit ecosystem and the entire DeFi space.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with over a hundred million dollars. Orbs pioneers the concept of L3 infrastructure, by utilizing Orbs’ decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs and GameFi.

DEX-AMMs offer 2 types of basic orders: Swap (market order) and limit order. Now, as of today, offer their users decentralized algorithmic trading orders.

dTWAP (Decentralized Time-Weighted Average Price) is a common algorithmic trading executing strategy in CeFi that seeks to minimize a large order’s impact on the market by dividing it into a number of smaller trades and executing these trades at regular intervals over a specified period of time.

Using the dTWAP order, SpiritSwap’s users can now optimize their trading by executing more sophisticated trading strategies. These include, among other things, the ability to significantly reduce price impact when executing large orders or in cases of fragmented and low liquidity, automation of Dollar-Cost Averaging (DCA), and more.

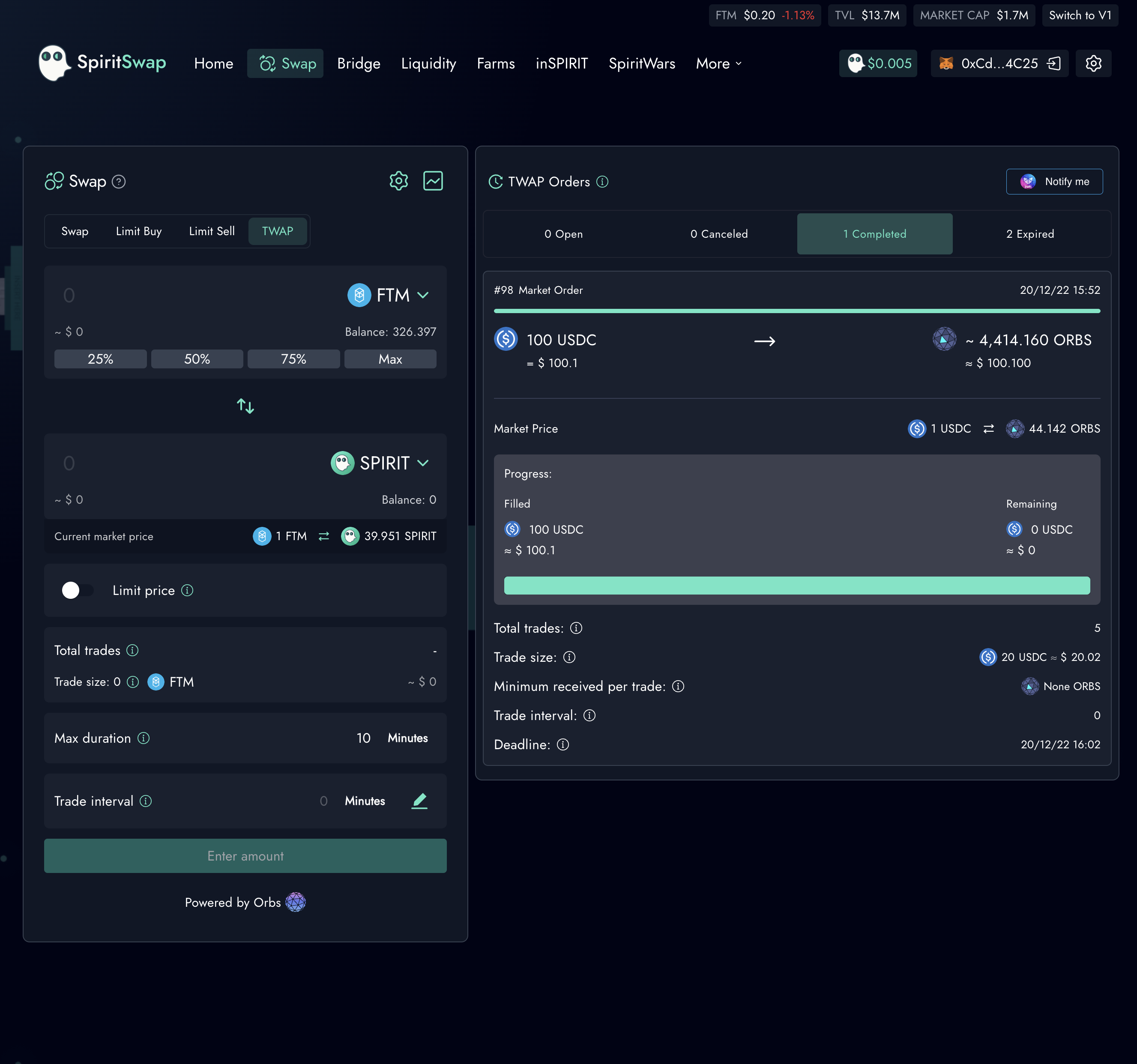

SpiritSwap users can now find the dTWAP order in the DEX’s application UI which provides an intuitive, user-friendly and informative way for users to set the parameters for and initiate dTWAP trades.

The dTWAP UI has 3 basic parameters which the user needs to specify:

These parameters allow for a lot of flexibility for the user when placing the order, taking into account factors such as market conditions, current gas fees, etc. In addition, the UI enables both dTWAP-market and dTWAP-limit orders. Once all of these parameters are set, the user will have the ability to Approve the specific source token and place the order.

Harnessing the ability of Orbs’ unique L3 infrastructure to expand the capabilities of DeFi platforms can allow DEXs to provide highly efficient dTWAP orders to its user base without sacrificing decentralization. With Orbs’ decentralized backend ensuring that dTWAP orders are executed at an optimal price and at fair fees, this type of trade can become a viable option for DEX users, giving them a number of new ways to make their trading activities more sophisticated. In turn, DEXs themselves can benefit from increased liquidity and attract new users by offering features that are currently unavailable on competing DEXes that do not utilize this technology.

The dTWAP integration by SpiritSwap paves the way for other leading DeFi protocols to follow suit. The Orbs team is currently working with other DEX-AMMs on integrating the dTWAP protocol onto their platform.

About Orbs

The Orbs Network is an open, decentralized and public blockchain infrastructure executed by a secure network of permissionless validators using Proof-of-Stake (PoS) consensus.

Orbs is set up as a separate decentralized execution layer operating between existing L1/L2 solutions and the application layer, as part of a tiered blockchain stack, without moving liquidity onto a new chain. Orbs acts as a “decentralized backend”, enhancing the capabilities of existing smart contracts and opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs and GameFi.

Orbs was founded in 2017 and launched its mainnet and token in March of 2019. Orbs is being developed by a dedicated team of more than 30 people, with offices in Tel Aviv, London, New York, Tokyo and Seoul.

For more information, please visit www.orbs.com, or join our community at:

Telegram: https://t.me/OrbsNetwork

Twitter: https://twitter.com/orbs_network

Learn more about Orbs

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.