SpookySwap, a leading DEX on Sonic, is among the first integrations to go live with dSLTP, the new stop-loss protocol powered by Orbs L3 technology. This rapid integration highlights the strong demand for decentralized stop-loss and take-profit orders and demonstrates how quickly the Orbs ecosystem is expanding as demand from traders to have a CEX like experience grows.

With dSLTP now live on Sonic, traders can set automated stop-loss and take-profit conditions for any swap, giving them precise control over risk and execution directly on a DEX, for the first time, anywhere.

Powered by Orbs’ decentralized Layer-3 infrastructure, dSLTP is fully permissionless, trustless, and composable, enabling any DEX to integrate stop-order automation without centralized servers or off-chain executors. With Spooky adopting the protocol, Sonic traders now have access to robust, on-chain risk management tools.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with tens of millions of dollars in TVL. The protocol optimizes on-chain trading with L3 use cases that include aggregated liquidity, advanced trading orders, and decentralized derivatives, enabling a DeFi trading experience as efficient as CeFi.

SpookySwap is one of the busies DEXs on Sonic and a significant hub for liquidity and active trading. By integrating dSLTP, SpookySwap becomes one of the first venues to offer on-chain stop-loss and take-profit automation, anywhere, bringing serious risk-management tools to everyday DeFi users.

Stop-loss and take-profit orders allow traders to:

A stop-loss order triggers a sell transaction if the market price falls below the trader’s set stop price. This is a vital tool in volatile markets where tokens can move sharply within minutes.

A take-profit order executes once price rises to the target level, securing gains and preventing missed profit opportunities.

Used together, these tools create a balanced trading approach that captures upside while limiting downside exposure. Until now, such functionality has been exclusive to centralized exchanges. dSLTP changes this, bringing robust, decentralized stop-order automation on-chain for the very first time.

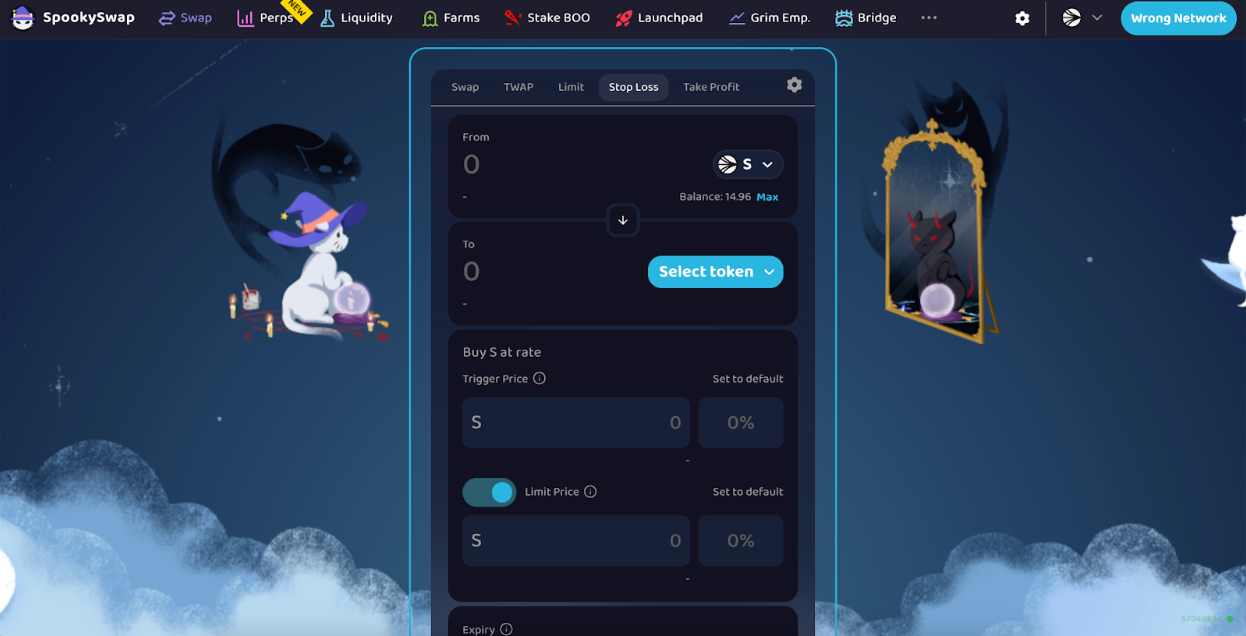

Spooky’s integration delivers a streamlined, intuitive interface for configuring stop orders with precise controls.

Stop-Loss Orders

Stop-loss orders help traders protect against sharp downside moves. A stop-loss is typically placed below the current market price and is designed to close all or part of a position if the price drops to a defined level.

Take-Profit Orders

Take-profit orders allow traders to automatically secure gains once the price reaches their target. A take-profit is typically set above the current market price and triggered when that price is reached.

Traders can customize each stop-loss or take-profit order using several key parameters:

Percentage-based configuration: set conditions such as trimming at +20%, securing profits at +50%, or exiting entirely at a 100% increase.

These parameters allow traders to tailor execution to their specific strategy, market conditions, and risk tolerance.

Once all parameters are set, users approve the source token, submit the order, and can monitor, edit, or cancel it through the order history interface.

dSLTP is the newest protocol powered by Orbs L3 technology, joining dLIMIT and dTWAP as the industry-standard suite for advanced decentralized trading orders. Generating millions in automated monthly trading volume, Orbs continues to push DeFi toward more sophisticated trading execution.

Stop-loss and take-profit orders are among the most widely used tools in traditional finance. With the arrival of dSLTP on Spooky, these essential trading features are now available to every trader on Sonic, fully decentralized and transparent.

Find out more:

About SpookySwap

SpookySwap is an automated market-making (AMM) decentralized exchange (DEX) built on UNIV3 for EVM-compatible networks. As the premier DEX on Fantom, Horizen, and BitTorrent Chain, Spooky is committed to delivering a seamless DeFi experience with a strong foundation powered by our BOO token, which supports governance, diverse farming options, and a built-in bridge. Spooky remains dedicated to user-centered service as we continue to grow our unique presence across the crypto space.

More information: https://v3.docs.spooky.fi/

About Orbs

Orbs is a decentralized Layer-3 (L3) blockchain designed specifically for advanced on-chain trading. Utilizing a Proof-of-Stake consensus, Orbs acts as a supplementary execution layer, facilitating complex logic and scripts beyond the native functionalities of smart contracts. Orbs-powered protocols, including dLIMIT, dTWAP, Liquidity Hub, and Perpetual Hub, push the boundaries of DeFi by introducing CeFi-level execution to on-chain trading.

With a global team of over forty dedicated contributors based in Tel Aviv, London, New York, Tokyo, Seoul, Lisbon, and Limassol, Orbs continues to innovate at the forefront of blockchain technology.

For more information, visit www.orbs.com or join our community:

Telegram: https://t.me/OrbsNetwork

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.