PancakeSwap recently launched the Orbs Syrup Pool on BSC.

Soon after, Alpaca Finance announced that they are adding Orbs to their farming pools!

Alpaca Finance is one of the most innovative DeFi projects on Binance Smart Chain. As of today, it is the largest lending protocol allowing leveraged yield farming on BSC. In this new initiative, Orbs holders will be able to increase their yields by using the Grazing Range and Leveraged Farming features offered by Alpaca.

Alpaca Finance is an advanced DeFi protocol, involving more sophisticated tools than your average AMM. We highly recommend to everyone who is not familiar with how Alpaca Finance works, to read through their documentation and make sure they understand the risks involved.

Please also see our disclaimers below.

Here is a short tutorial and a summarized process flow for using the Orbs token on the Alpaca platform:

Go to the FARM tab and choose the ORBS-BUSD farm.

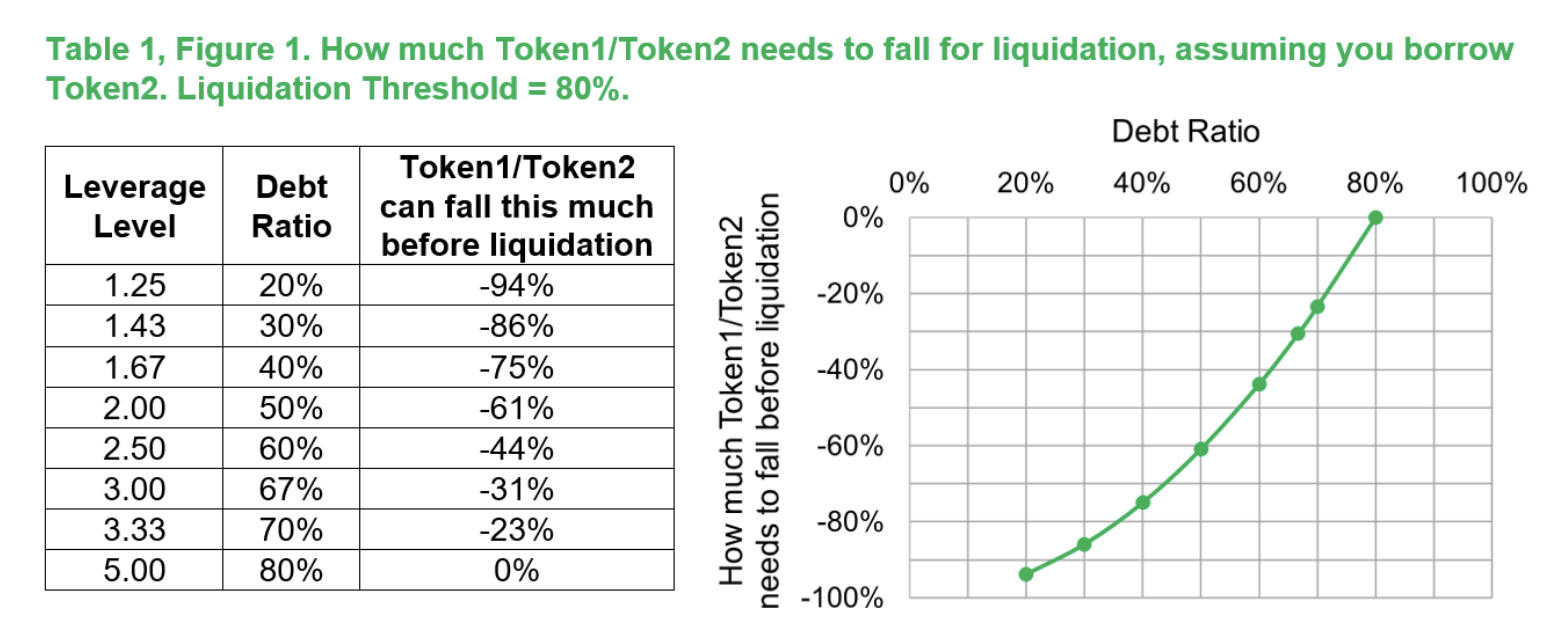

Enter quantities for each token and set the leverage which can vary from x1️ (no leverage) to x2 (maximum leverage). In order to use leverage, you will need to borrow BUSD. Alpaca will balance out the pair weights to provide liquidity at a 50:50 ratio.

When opening a leveraged farm, you are eligible to earn ALPACA tokens.

Once the position is opened, you can always re-adjust the parameters:

Next, you can deposit the ALPACA tokens in step 1 in the LEND tab, to receive ibALPACA tokens. These tokens will be deposited in the Alpaca lending vaults and are then offered to yield farmers for leveraging up their positions.

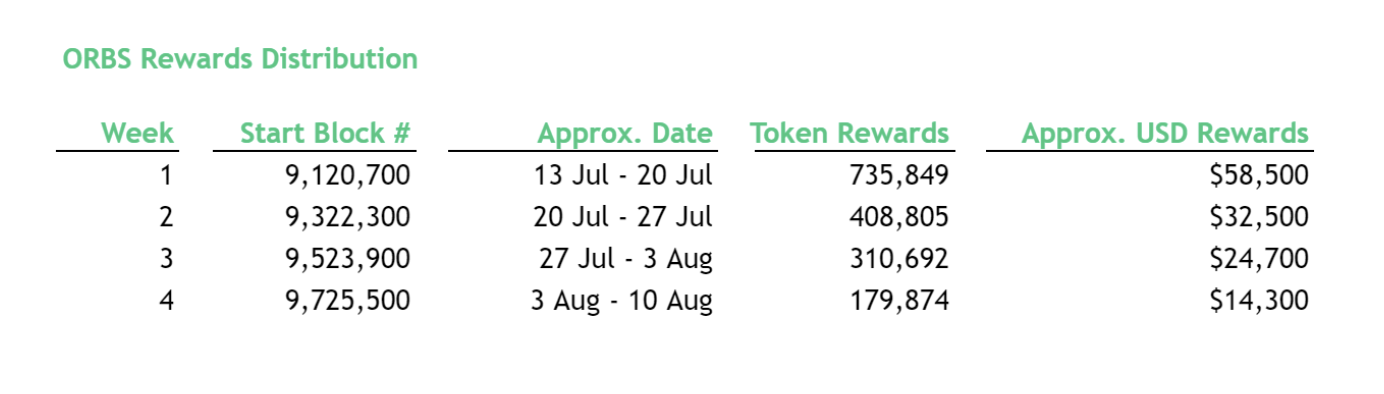

In the Grazing Range tab, you will be able to stake the ibALPACA in order to earn ORBS tokens.

Please Note

_Use of Alpaca Finance, PancakeSwap AnySwap bridge and the other platforms and services described above carries significant risk. Digital assets, decentralized finance products, especially those that utilize margin or leverage, are, by their nature, highly risky, experimental and volatile. Such platforms and services may be subject to security and economic risks and exploits and transactions may be irreversible, final and without refunds. Such use carries a risk of substantial losses. In particular, the use of products that utilize margin or leverage magnifies exposes you to a risk of liquidation and full loss of your position. _

Any use of any platform, application and/or services described above is at your own risk and you are solely responsible for all transaction decisions. You should do your own research and independently review any third-party services and platforms and any applicable information terms, conditions or policies applicable to such platforms and services.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.