(/assets/img/blog/introducing-orbs-liquidity-nexus-liquidity-as-a-service/1_b1GMs87GwaJSdKLAY9i-dw-1030x434.png)

The Orbs Liquidity Nexus introduces CeFi sourced liquidity to DeFi.

CeFi players are showing massive interest in the potential returns of DeFi. DeFi positions are thirsty for the boundless liquidity of the CeFi world. Orbs Liquidity Nexus is a decentralized protocol for facilitating the bridge between the two.

···

The majority of businesses around the world manage their capital in fiat. Consider a company like Apple, which ended Q1 2021 with $196 billion in cash reserves. This money doesn’t stand still, and is managed by subsidiaries like Braeburn Capital using traditional CeFi instruments to make returns and protect against inflation. There are countless other hedge funds in CeFi that perform this task professionally.

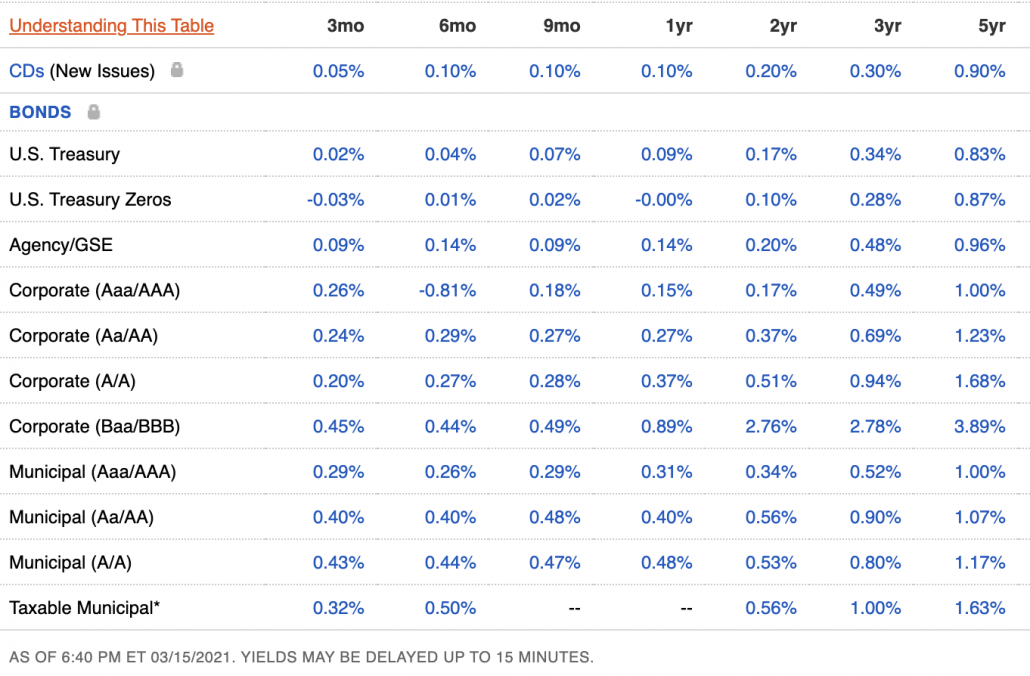

How well can your cash reserves perform in CeFi? As interest rates are dwindling globally, it becomes harder than ever to produce returns and protect cash reserves against inflation. Here are recent market numbers taken from Fidelity for relatively low-risk investment avenues — treasuries and corporate bonds:

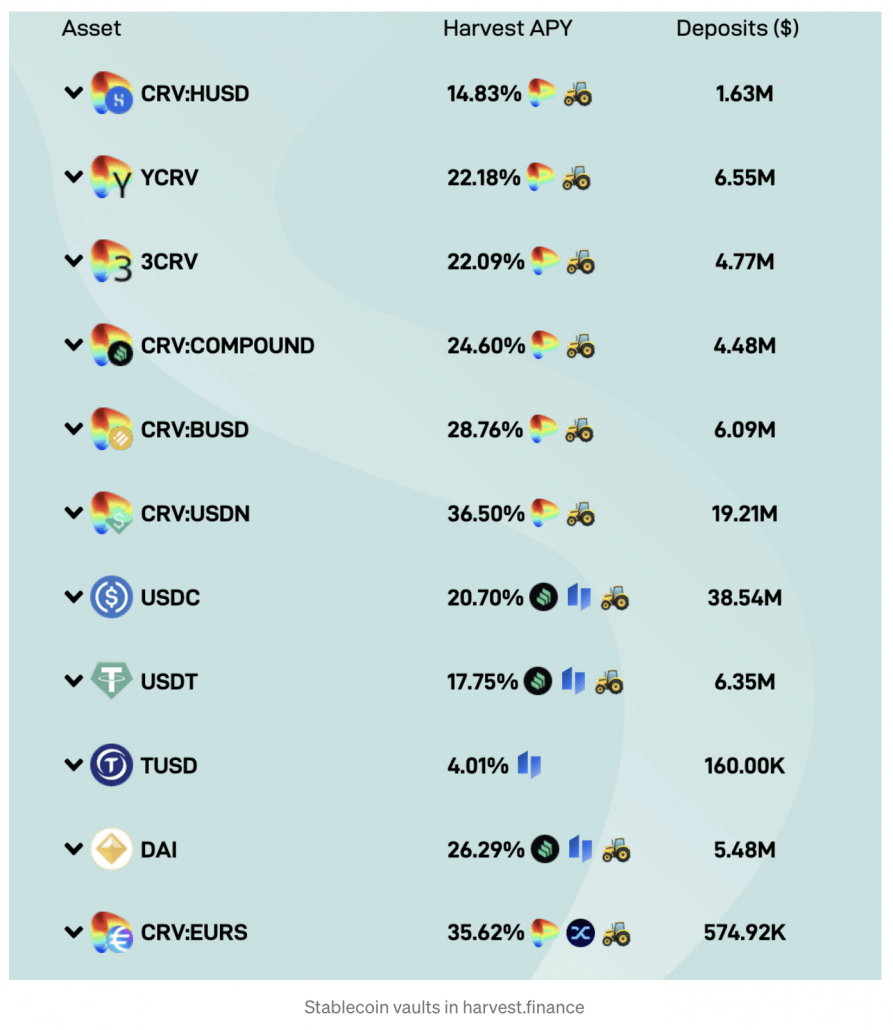

The last year is showing somewhat unbelievable figures for investment yields in DeFi positions. Note that we are not measuring performance of volatile crypto assets, but what returns can be achieved over stable assets like USDC.

Orbs is usually focusing on EVM-compatible ecosystems, Ethereum being the largest one (EVM stands for Ethereum Virtual Machine). DeFi vaults such as yearn.finance and harvest.finance, which act as decentralized hedge funds, provide some indication on potential returns:

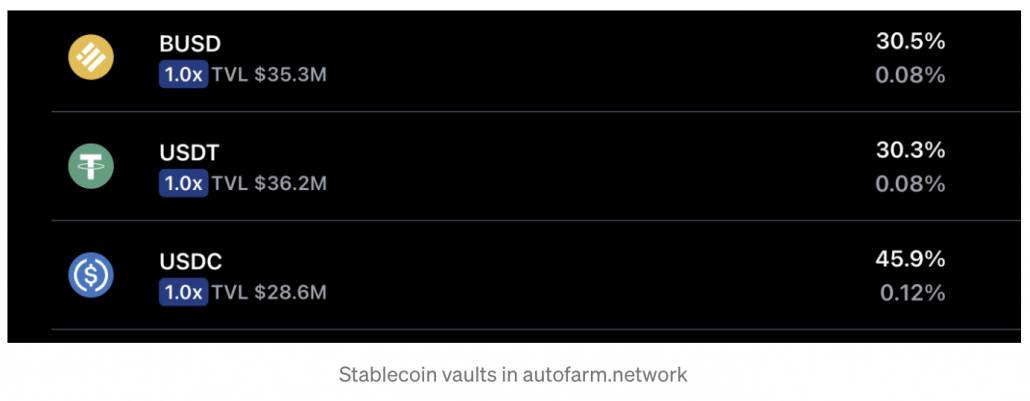

Binance Smart Chain is another EVM-compatible ecosystem we’re focused on, having similar products like autofarm.network and acryptos.com which show comparable numbers for stablecoins:

These avenues perform in an order of magnitude better than their traditional centralized counterparts, but they are not without their risks. A quick look at the rekt leaderboard reminds us that DeFi is a sector that requires significant expertise to participate in and suffers from many growing pains.

The returns in DeFi are somewhat higher than what most traditional finance experts would anticipate. Many skeptics ask whether these numbers are sustainable or are just a byproduct of the sector’s explosive growth and hype mixed with the bull run of the crypto industry as a whole.

This is an interesting question and out of the scope of this post, but I will say that I believe that there are fundamental reasons which help DeFi perform better. These include the elimination of many middlemen which are abundant in the CeFi world (banks for example) and the increase of transparency and fair play, which levels the playing field for all players to enjoy numbers that are traditionally reserved in CeFi for the select few.

The bottom line is simple — DeFi is an emerging competitive avenue for CeFi players. And this trend is only expected to grow.

Living and breathing DeFi every day makes it seem that DeFi is everywhere. It is actually humbling to look at the numbers and see how tiny DeFi is in comparison to the outside world.

The entire crypto market cap is currently valued at $1.7 trillion. Even if all of it was attributed to DeFi, it is still a small fraction of the global economy. According to SIFMA, the global bond markets outstanding value in 2019 was $105.9 trillion and the global equity market cap in 2019 was $95 trillion.

The bottom line here is also simple — there’s a lot of money in CeFi and only a tiny part of it is currently exposed to DeFi.

Like any bridge infrastructure, the decentralized protocol has two sides:

One of the historic differentiators of the Orbs project is its ability to bridge the chasm between the decentralized world and the centralized one.

On one hand, Orbs is a public and permissionless blockchain, with a PoS incentive layer built on the ORBS token and operated by a decentralized community of Guardians and Delegators. On the other hand, Orbs has a history of operating in enterprise markets and experimenting with real world for-profit businesses, which are embedding the potential in blockchain for the very first time.

This expertise makes the Orbs project well positioned for the task at hand — creating the protocol to bridge the gap of liquidity between DeFi and CeFi.

The product challenges are plenty, since DeFi is not an easy pill to swallow for most CeFi players. Several layers can be addressed by the protocol for them to participate more freely, such as:

Learn more about the Liquidity Nexus protocol (when the time comes) in:

If you’re curious about what we’re working on and don’t mind seeing work-in-progress that hasn’t been properly announced yet, feel free to follow us on Github:

···

Notes

This document details a project which is currently being researched by the Orbs team and ecosystem contributors. The project is currently in concept mode and is being portrayed herein as currently envisioned by the Orbs team.

Orbs is a decentralized project driven by community contribution and guidance. The product and functionality detailed in this document therefore constitute a mere proposal assembled from community feedback and are subject to change continuously as new requirements arrive. This document provides no guarantee that any offering, product, or specific feature will become fully or partially developed.

The information contained in this document shall not form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.