We are excited to announce that Orbs has been added to WOWswap!

WOWswap is a fast-growing DeFi protocol that brings leveraged trading into the DeFi space. Orbs token holders will now be able to buy and sell ORBS tokens with up to 5X leverage on the WOWswap protocol.

WOWswap is a decentralized leveraged trading protocol that runs on Binance Smart Chain, HECO and Polygon Network.

WOWswap’s smart contracts enable traders to borrow funds in order to finance their leveraged trades on decentralized AMMs such as Pancakeswap.

You can now swap Orbs on WOWswap at the following link:

WOWswap also offers swaps with leverage.

Leverage is a financial tool that allows a trader to get greater market exposure with a relatively small amount of initial capital. When trading with leverage, a trader funds only a portion of a trading position and borrows the rest from external liquidity providers. Opening leveraged positions can be very risky and users should be aware of these risks and consequences, some of which are discussed below.

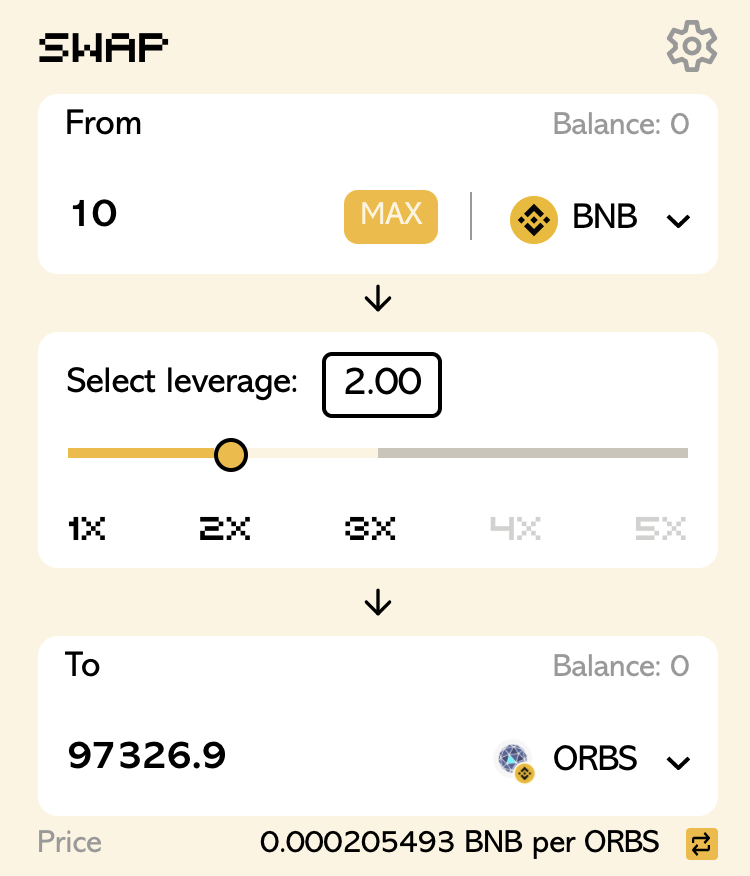

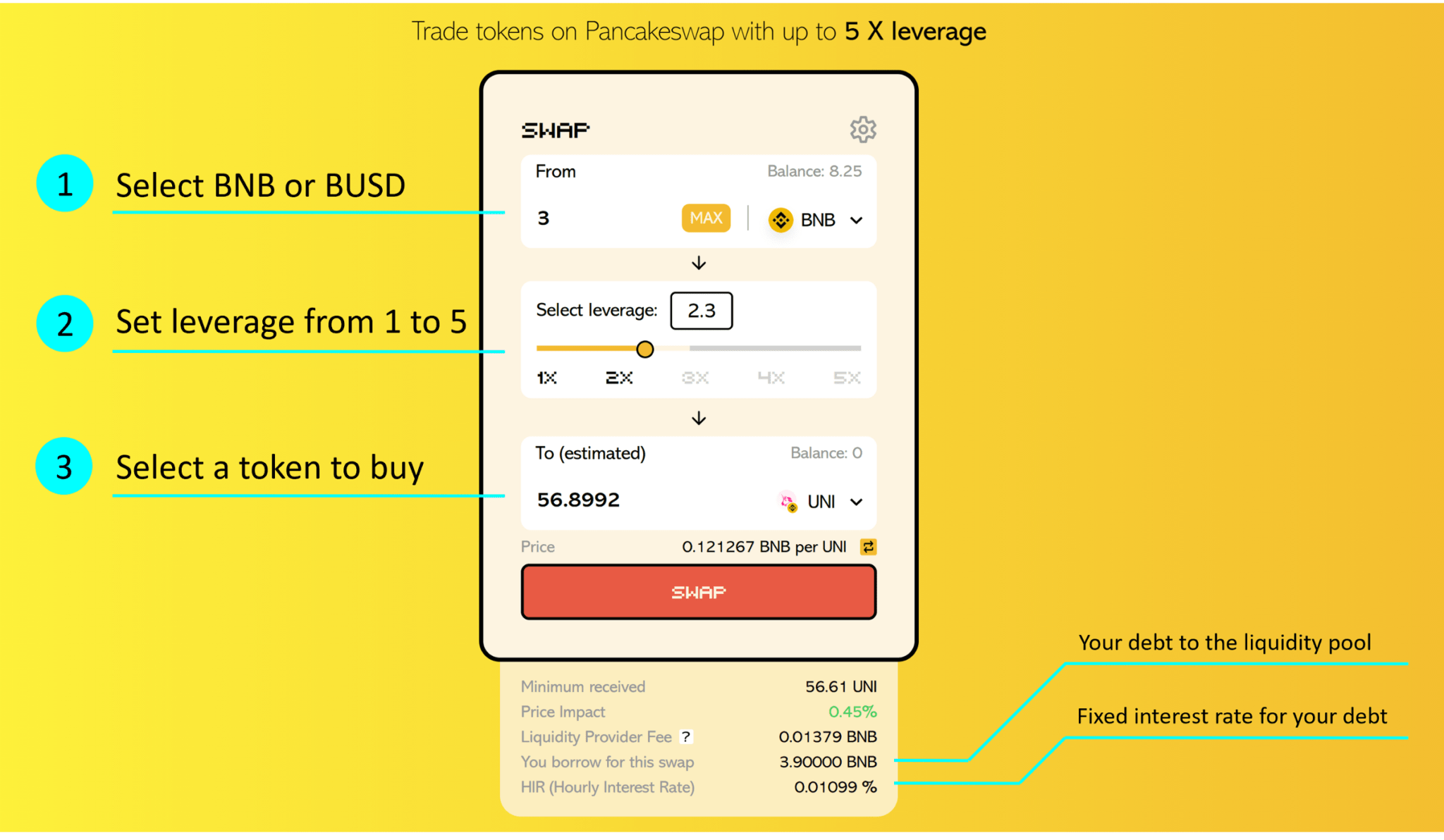

WOWswap has an extremely simple interface. Users can move the leverage slider to the right to set the leverage coefficient which can vary from x1️ (no leverage) to x5️ (maximum leverage).

When you buy a token with leverage you finance only a portion of the purchase with your own capital — the rest of the funds you borrow from a liquidity pool. In the lower part of the swap screen, you will see information about your loan and Hourly Interest Rate (HIR).

After you complete a swap you will get “proxy-tokens”, which are pegged 1:1 to real tokens held by WOW smart contract on your behalf. Proxy-tokens are needed for the protocol to guarantee the repayment of your loan.

Learn more about opening and closing a leveraged position on WOWswap here.

As mentioned above, WOWswap traders can buy and sell their favorite tokens with up to 5X leverage by borrowing extra capital from the lending pool.

Leveraged trading always entails risks of Liquidation.

In general, liquidation of a trading position can happen as a result of the following 4 events or their combinations:

We highly recommend that any Orbs holders planning to trade on WOWswap make sure they understand the liquidation risks and all other relevant risks when opening a leveraged position.

The Orbs project’s integration into BSC has been booming in recent weeks!

After adding the ORBS token to PancakeSwap at the end of April 2021, we have seen great follow-up initiatives taking place on BSC:

PancakeSwap has launched the Orbs syrup pool which is the most liquid Orbs pool on any DEX; Beefy Finance has added Orbs to their vaults; Alpaca Finance has also chosen to launch an Orbs campaign.

And now, WOWswap has also decided to add the Orbs token to their protocol!

All of the above led to a significant increase in the Orbs community’s on-chain activity on BSC. Furthermore, such integration by leading protocols exhibits confidence in the Orbs project and further solidifies Orbs’ presence in the DeFi space.

Please Note

Use of WOWswap, PancakeSwap AnySwap bridge and the other platforms and services described above carries significant risk. Digital assets, decentralized finance products, especially those that utilize margin or leverage, are, by their nature, highly risky, experimental and volatile. Such platforms and services may be subject to security and economic risks and exploits and transactions may be irreversible, final and without refunds. Such use carries risks of substantial losses. In particular, the use of products that utilize margin or leverage magnifies exposes you to a risk of liquidation and full loss of your position.

Any use of any platform, application and/or services described above is at your own risk and you are solely responsible for all transaction decisions. You should do your own research and independently review any third-party services and platforms and any applicable information terms, conditions or policies applicable to such platforms and services.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.