(https://www.cnbc.com/2021/03/17/coinbase-valuation-rises-to-68-billion-ahead-of-crypto-listing.html). Had someone predicted any of the above only a few months ago (let alone more than a year ago...), she may have been laughed off of her blog...

Decentralized Finance, or DeFi, is one of the main pillars of this trend, reaching a record of over $60B in total value locked (TVL) by mid-April 2021 with an endless stream of new ideas, solutions and funding. In a previous post, we discussed the opportunity that DeFi may hold for the unbanked, based on the critical role of stablecoins. Since then (October 2020) TVL has increased fivefold. A staggering pace indeed.

In many respects, the traditional financial platform and the DeFi ecosystem are parallel universes. Both provide a plethora of financial services and instruments for investors with a growing similarity. Usually, the DeFi universe is inspired by traditional finance services, and creates an updated version of those services on steroids, e.g. yield farming and flash loans. While each universe works quite well on its own, problems emerge when trying to migrate from one to the other. In this post, we discuss some of these issues. For convenience matters, we will use the terms Fiat and Crypto markets to denote the traditional financial system (Centralized finance or CeFi) and DeFi, respectively.

Migrating from Fiat to Crypto gets less challenging everyday. More and more service providers, e.g. exchanges, brokers, etc. allow purchasing cryptocurrencies using credit cards and bank transfers. These conversions involve significant fees, much higher than those involved in FX conversion or even buying stocks, but this is likely to diminish with time as competition grows. The main barrier is still the common notion that “it is complicated” and requires advanced skills and knowledge. While it does require both, so did opening a bank account 50 years ago. Let me assure you that anyone who’s willing to spend a brief few hours reading about it can successfully accomplish this task. Those who do not will just have to wait until banks start providing this service. Some already do, and my guess is that many more will follow.

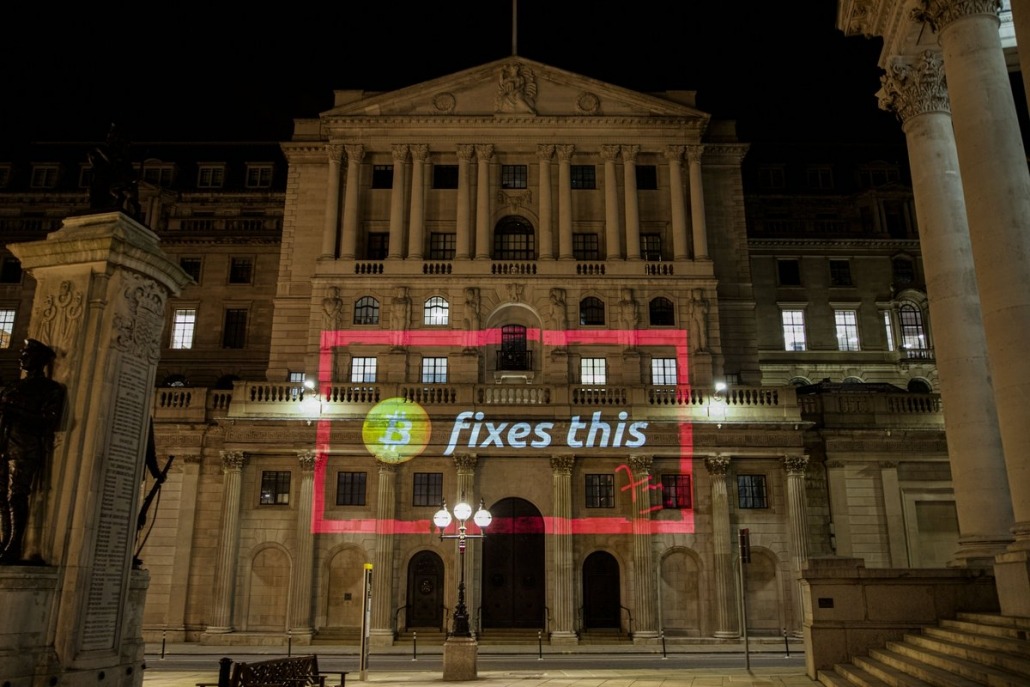

The real difficulty lies in the opposite direction. In fact this process can be excruciating for businesses and individuals due to the conservative nature of banks, persistent in their unwillingness to accept funds originating in cryptocurrency activities. In Israel for example, blockchain companies were charged by the tax authorities on their crypto profits, but many of them were unable to repatriate funds in order to pay the taxes they were charged!

To be fair, banks are not the ones to blame, as they are not the source of the problem, only its agents who face the frustrated customers. Most governments and regulators set (at best) partial, and usually no, AML and KYC regulations concerning cryptocurrencies. Consequently, banks lack clear instructions on how they should handle these funds, while at the same time they bear full legal liability for their sources. Naturally, this lack of clarity puts them in an awkward position and practically leaves them with only two choices. They could either establish an elaborate strategy and internal guidelines for analyzing such fund sources and ultimate beneficial owners, or they could refuse to accept them. Three guesses which is the most popular choice, and the first two guesses don't count.

Adding to that is the sad truth that cryptocurrencies are sometimes used by malicious actors, whether on the Darknet or other channels, in order to finance illegal activities. In that sense, it is highly demoralizing that DeFi provides them with new potent financial instruments to manage their funds more efficiently. As we explained in a previous post, DeFi allows the unbanked to participate in the financial system due to the ease of generating and managing a digital wallet. The downside is that malicious actors benefit from that as well, by getting a powerful technology to easily bypass strict AML regulations.

To recap this point, potential DeFi investors must take into consideration that it might take a while before they are able to cash out profits from their bank account. How much is “a while”? Your guess is as good as mine.

Therefore, it is obvious that governments must move faster towards regulating crypto. Parts of it would rely on existing AML and financial compliance concepts, only adapted to the new market with its new challenges. Other parts may require an overhaul and a re-evaluation of which methodologies are still relevant and can be applied differently and which ones are outdated and should be updated. It is no surprise that tools that provide chain analysis, sanction compliance, financial crime prevention and more are already available. Naturally new regulation is never an easy task, however, it can and should be a differentiator between regulators who stand to the challenge and are looking to adapt in face of innovation, and those who prefer to follow and lag behind.

The key advantage of adopting new regulations is taxes, which actually withholds two benefits. The first and trivial one is straightforward - new regulation will attract new entrepreneurs, companies and investors who will generate new financial activity, thus new taxes. The other one is a bit more subtle. As this activity lacks proper regulation, most investors cannot declare their profits and be taxed accordingly. Proper regulation could release them from this situation, into which they were forced. We can only assume that the lion's share of investors is law-abiding citizens who would opt-in to being legally taxed rather than having to bear with unknown consequences of alleged non-voluntary tax evasion. Needless to say that both benefits would only intensify as more enterprises are involved in the Crypto market.

To sum it all up, I strongly believe that cryptocurrencies are here to stay and are already on a clear path towards adoption by mainstream enterprises and governments. Therefore regulators must be as responsive as they can to support and accommodate the financial system. They will have to do their best to adopt, improve and develop AML and other financial compliance methodologies. It is a difficult task as regulators are conservative, and in certain situations, they definitely should be, thus they require time to analyze and predict all potential directions that markets are going to. The problem is that these markets are driven by skilled entrepreneurs, who cannot and will not wait, but will rather keep pushing the envelope towards innovation and new solutions. Regulators will have to do their best to keep up with them.

My estimation is that with time both universes will consolidate into a single one. When that happens we could all reminisce about the good old days before there were digital USD, Euro or Yuan and you couldn’t even pay with your digital wallet at the supermarket. Even though I can’t tell when those days will come, I am sure that the future of this industry will be anything but boring.

···

Netta Korin is a cofounder of Orbs. Prior to Orbs Netta worked for many years on Wall Street as a hedge fund manager. She later held senior positions in the Israeli government, including Senior Advisor in the Israeli Ministry of Defense to General Yoav (Poly) Mordechai, Head of CoGAT, and Senior Advisor to Deputy Minister Dr. Michael Oren in the Prime Minister’s Office in Israel, focusing on Palestinian issues. Netta has held board positions in several non-profit foundations in both Israel and the United States. She also founded The Hexa Foundation with the aim of promoting blockchain for social impact and harnessing the mind power of the Orbs ecosystem and network to help solve the region’s and the world’s most pressing humanitarian problems.

For more information please contact Netta Korin (netta@orbs.com)

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.